- Bits + Bips

- Posts

- Are Investors in Ripple’s $500 Million Raise Just Buying Discounted XRP?

Are Investors in Ripple’s $500 Million Raise Just Buying Discounted XRP?

Investors got into Ripple at a steep price. But what did they get besides XRP?

I’ve long had questions about Ripple’s business model. After all, the company has been around for almost a decade and a half, and it is difficult to see what they’ve accomplished besides selling XRP.

Nevertheless, they just announced a big round at a lofty valuation. Is this the sign of big things for the company, or is it just a hidden DAT investment in the company?

Before we dive in, I want to hear from you!

Let me know the stories you want covered through a quick survey.

Today’s newsletter is brought to you by Mantle

Mantle is building the Blockchain for Banking — where TradFi meets Web3. Explore real-world financial tools, powered fully on-chain.

Are Investors in Ripple’s $500 Million Raise Just Buying Discounted XRP?

The company raised funds at a $40 billion valuation. But it already owns $80 billion worth of XRP.

Did investors just get a lot of XRP at a big bargain? (ChatGPT)

Ripple Labs just announced a $500 million raise at a $40 billion valuation from a high-profile group of investors including Brevan Howard, affiliates of Citadel Securities, and Marshall Wace. Also involved in the round were major crypto shops like Galaxy and Pantera.

But what exactly did they buy with their half a billion dollars?

Ripple has been on a buying spree of its own as of late. In the last few months it has bought Palisade, a custody platform, Hidden Road, a $1.25 billion prime broker, and Rail, a stablecoin infrastructure platform. It also recently launched RLUSD, its proprietary stablecoin that just crossed the $1 billion threshold. Its XRP token is expected to get its first spot ETF in the U.S. sometime next week, and it is applying for a national bank charter with the Office of the Comptroller of the Currency.

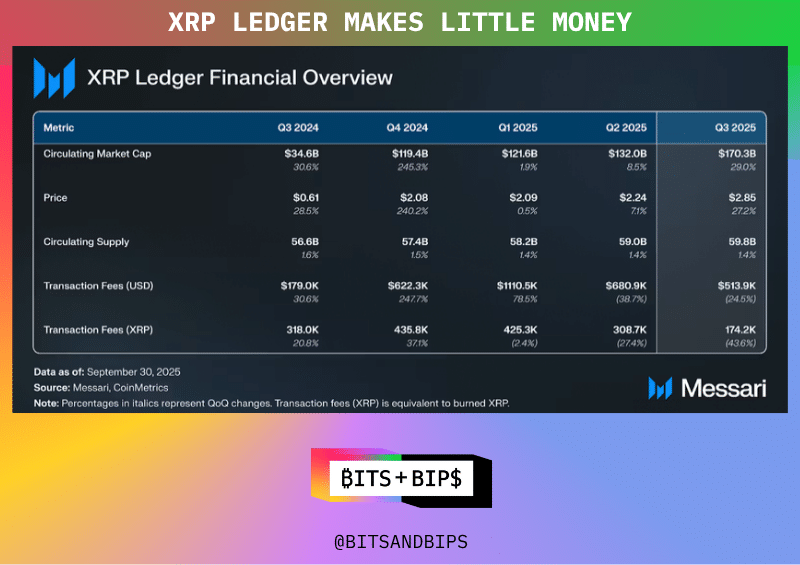

(Messari)

Despite this momentum, it seems hard to justify anything close to a $40 billion valuation. Especially given the fact that the XRP Ledger still generates less than $200,000 a month in the way of fees. So what gives?

According to multiple investors and venture capitalists who spoke to Unchained on the condition of anonymity, this deal has very much to do with buying into Ripple’s XRP holdings, likely at a steep discount to the spot price.

“[The company] is not worth anything outside of XRP holdings. No one uses their tech. No usage on the network/blockchain,” said one prominent venture capitalist.

“Ripple equity isn't likely worth very much on its own, certainly not $40 billion,” said another.

XRP Riches

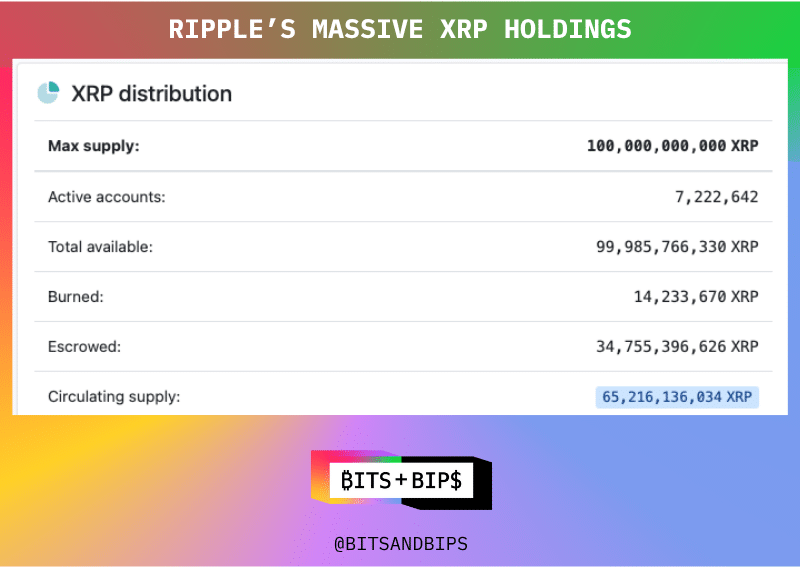

One could easily make a case that Ripple Labs is the richest company in crypto (even if it is not the most valuable). As part of an early distribution strategy when the company and blockchain were first set up, Ripple Labs was given 80 billion of XRP’s 100 billion supply in escrow to be released on a quarterly basis.

Today, the company still holds 34.76 billion tokens, with 1 billion being released every month. Typically 60-70% of the tokens are then relocked, with the rest being used to fund operational expenses. At today’s price of $2.32, these tokens have a nominal value of $80.63 billion.

(XRPscan)

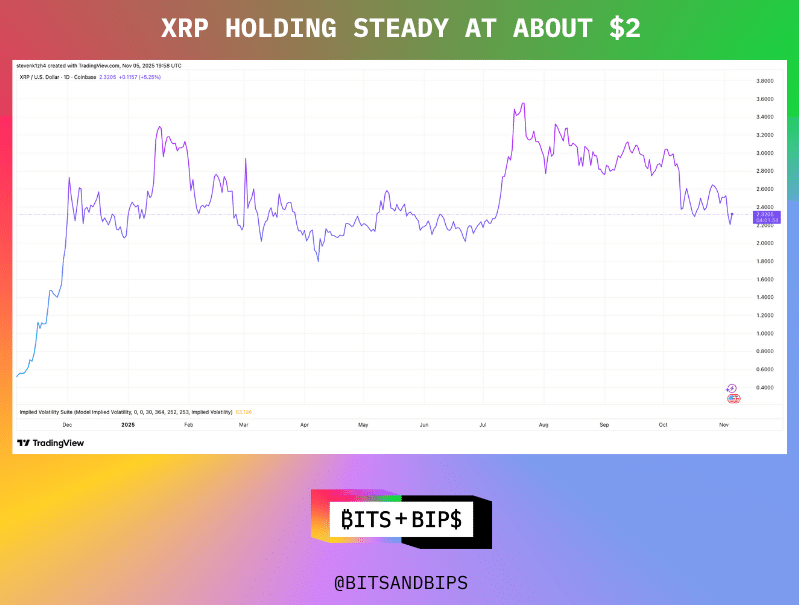

(TradingView)

A Private XRP DAT?

If you think of this investment in terms of a digital asset treasury (DAT), then it begins to look like a compelling offer for investors. After all, buying into a company at a $40 billion valuation when it already has $80 billion in assets on its platform amounts to a 50% discount or an mNAV (multiple to net-asset value) of 0.5. Typical investment pitches for DATs offer opportunities for investors to get into companies with mNAVs closer to 0.7 or 0.8.

Things are not quite that simple, as Ripple would likely get nowhere near $80 billion if it was able and willing to liquidate all of its XRP on the spot market today. But even given a 50% discount for these holdings, which one investor not involved in the round said was reasonable, it would still mean that the investors were buying into the company at an mNAV of 1 with all of the potential upside that comes with the company’s recent moves and acquisitions.

All of the investors in the round declined to respond to Unchained’s questions about the investment, particularly the role that Ripple’s XRP holdings played in the decision-making process and price. A request for comment from Ripple was not answered before the story went to press.

However, an individual familiar with one of the participants noted that the companies involved have done business with each other for years and that, especially in the world of payments — which is particularly hot right now in light of the passage of the GENIUS Act in July and the focus on stablecoins — investors need to bet on multiple horses in the race.

But, perhaps with a nod to Ripple’s gargantuan treasury holdings, the individual also admitted, “Even if they can’t [build a successful business] themselves, they can just buy another company.”

What’s in It for Ripple?

Although Ripple did not respond to requests for comment, a former employee noted that this funding round offers a few advantages. For starters, it solidifies the $40 billion valuation that company shares were trading at on platforms such as Carta. The individual noted that the company has likely spent over $1 billion buying back shares from early investors and employees.

It also gives the company some additional cash to fund further acquisitions without having to sell XRP, which could spook the market.

The irony is that the best-capitalized company in crypto may actually be cash-poor.

Related content:

Reply