- Bits + Bips

- Posts

- Berachain Documents Show Brevan Howard Fund Offered $25 Million Refund Right

Berachain Documents Show Brevan Howard Fund Offered $25 Million Refund Right

One firm has a secret way to get its money back from a plunging investment.

In the past it has been retail investors feeling aggrieved by project creators catering to venture firms. But this time those firms might have reason to be upset.

Today’s newsletter is brought to you by Mantle

Mantle has entered a new phase as the distribution layer connecting TradFi and onchain liquidity. To accelerate this vision, the Mantle Global Hackathon 2025 is inviting developers to build scalable RWA and DeFi products.

Why build on Mantle? It’s an ecosystem built for builders. You get direct access to Bybit’s 7M+ users for potential listing exposure, support from the $4B Mantle Treasury, and mentorship from top VCs like Spartan and Animoca Brands.

With 6 tracks—prioritizing RWAs and RealFi—and a $150,000 prize pool (plus grants), this is your chance to deploy on a high-performance modular L2.

Berachain Documents Show Brevan Howard Fund Offered $25 Million Refund Right

The favorable VC term could force Berachain to repay $25 million in cash to one of its lead backers.

Berachain gave a sweetheart deal to one of its investors (ChatGPT)

In late 2024, thousands of partygoers descended on a Singapore nightclub to attend a party co-hosted by an unlaunched, bear-themed blockchain named Berachain. The line for the event snaked through a Singapore mall and out of the frame of one incredulous onlooker.

By then Berachain had grown from a 2021 NFT project depicting pot-smoking bears to one of crypto’s buzziest new blockchains. The startup raised at least $142 million in venture capital, and its token valuation reached $1.5 billion in its last funding round, which was co-led by Framework Ventures and Nova Digital — a fund within $34 billion hedge fund Brevan Howard’s crypto arm.

Anchoring the raise was the brand of one of the most famous investment shops in the world, which bestowed credibility on Berachain. One ex-employee, who declined to be named, recalled Berachain’s anonymous co-founder Papa Bear once noting that Brevan could serve to legitimize the project.

But the Series B terms were an especially plum deal for Brevan’s Nova fund.

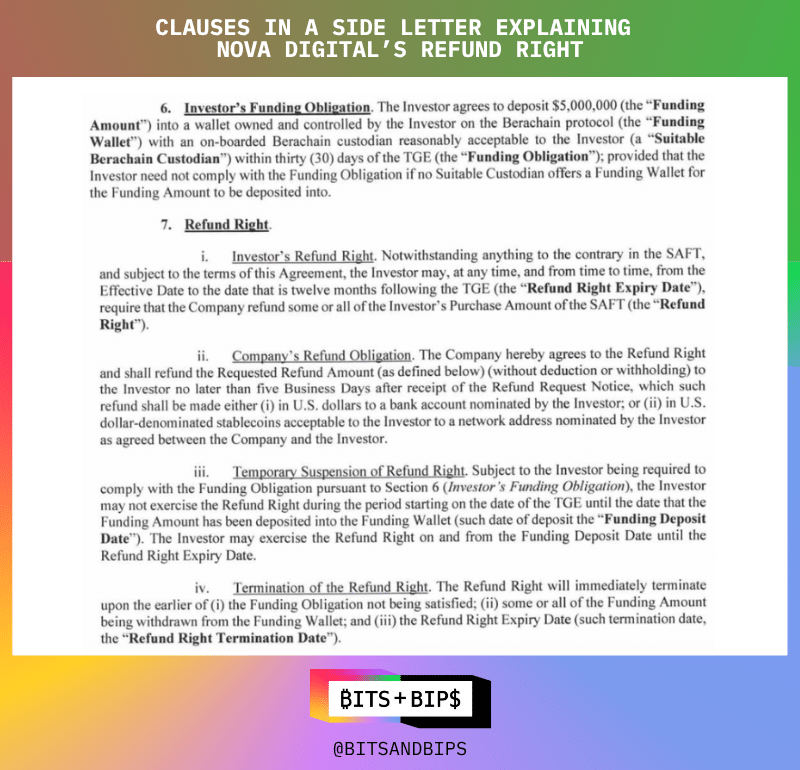

Documents obtained by Unchained show that Berachain granted the fund a refund right on its $25 million Series B investment for up to a year after Berachain’s token generation event (TGE) on Feb. 6, 2025. The refund clause means that, unlike a traditional venture investment, Brevan’s fund didn’t take on any risk to its principal. If Berachain’s BERA token performs well, the fund will reap the rewards. If BERA flops, the fund can ask for its money back.

Four crypto-focused lawyers said it was highly unusual for a crypto project to grant an investor a post-TGE refund right. When refund rights do occur in token fundraises, two of the lawyers said, they are typically only triggered if a project fails to launch a token.

Should Nova Digital ask for a refund on its investment, which would make financial sense as the token is down roughly 66% from its investment price of $3, it could force Berachain to pony up $25 million in cash to repay one of its own backers. Tokens purchased by Berachain investors are subject to a one-year cliff, according to the project’s documentation, so Nova would presumably forgo its BERA allocation if it were to exercise its refund right.

It’s unclear if the Nova fund’s refund right was legal — especially if the clause’s existence was not disclosed to other investors.

Nova Digital has until Feb. 6, 2026, to exercise the refund right.

Nova’s Bullish Bera Bet

Brevan Howard Digital’s Berachain deal was struck by Nova Digital Master Opportunities Fund Limited, a fund Brevan acquired from the crypto venture capital firm Dragonfly in 2023. Nova’s operation within Brevan Howard Digital was reportedly headed by Kevin Hu, who personally invested in Berachain’s seed round, according to a source familiar with the matter.

The Nova fund invested $25 million in Berachain in exchange for BERA tokens priced at $3 apiece as part of the blockchain’s Series B funding round, the documents show. Other investors included Polychain, Hack VC, Arrington Capital, and Tribe Capital. The refund right agreement was laid out in a side letter dated March 5, 2024, attached to Brevan Howard Digital’s term sheet, titled “Nova Side Letter.”

(Unchained)

The copy of Nova Digital’s term sheet that Unchained received can be viewed here. Nova Digital’s SAFT is here, and the side letter containing the refund right can be viewed here.

Brevan Howard Digital’s venture investors outside of the Nova fund have not asked portfolio companies for refund rights, the source said, adding to the peculiarity of this arrangement.

“[Unchained’s] reporting on this matter is both inaccurate and incomplete. Brevan Howard remains one of the largest investors in Berachain. Their investments involve several complex commercial agreements, but they participated in the series B fundraise on the same paperwork as all investors,” Berachain’s anonymous co-founder Smokey the Bera said in an emailed statement. The project declined to answer specific questions and Smokey the Bera did not elaborate on the commercial agreements.

Under the terms of the side letter, Nova Digital had to deposit $5 million into Berachain within 30 days of the TGE to exercise its refund right. Unchained could not verify whether Nova had deposited the $5 million or if the fund had exercised its BERA refund right. Brevan Howard Digital and Nova co-founder Ashwin Ramachandran declined to comment on the refund right. Hu did not return multiple requests for comment.

Nova Digital is now being spun out from Brevan Howard due to differences in risk tolerance and strategy, per the source familiar with the matter. The Nova fund will operate independently, and Brevan will not have any involvement with Berachain once the severance is complete. At the time of publication, Brevan Howard Digital is still listed as a backer on Berachain’s website.

A One-in-a-25-Million Offer

MetaLeX Labs co-founder and longtime crypto attorney Gabriel Shapiro, who estimated that he has worked on more than 50 token fundraising deals, said he has never heard of a post-TGE refund right being granted in any round.

“The most plausible reason a company would enter into an agreement with a lead investor where the lead investor has a complete, unconditional right to request a full refund of all invested amounts is because, by virtue of … being able to tell other investors … that this is the lead investor in the round, it would make them more likely themselves to invest or to trust the security of the chain,” he said.

In a rare recent example of token investors being granted a refund right, all parties were offered the term.

Flying Tulip, a project unveiled by DeFi developer Andre Cronje earlier this year, granted all investors an unconditional refund right in its $200 million funding round to provide downside protection in the investment. And, unlike in Berachain’s case, this “perpetual put” option was advertised publicly.

In crypto history, SAFT investors have occasionally received refunds for reasons like projects failing to launch a token within a given period of time. But even then, those deals did not provide a refund for poor price performance.

Was Material Information Omitted?

It's an open question whether or not Berachain had a legal obligation to disclose the redemption rights to other investors in the Series B, two attorneys familiar with capital markets regulation said. Generally, under the Securities and Exchange Commission’s Regulation D anti-fraud requirements, the company seeking funding must disclose “material information” to all investors, one attorney said, but the rules do not define what constitutes “material.”

Two investors in Berachain’s Series B, who spoke under the condition of anonymity, said Berachain did not inform them that another investor had a refund clause.

“If I had been an investor and someone approached me about investing in this round and they said, ‘It’s being led by Brevan Howard [Digital’s fund],’ and they didn’t disclose that Brevan Howard [Digital’s fund] had a full refund right as part of that, then I would most likely feel misled by the circumstances into investing,” Shapiro said.

Specifically, the refund right could also risk violating Most Favored Nation (MFN) rights, which give early venture investors the right to receive as good of terms as any later investor. At least one Berachain investor other than Nova Digital had an MFN clause that would apply to the Series B, according to multiple sources with knowledge of the matter.

“It depends on the terms of the MFN, but it is very likely that [Nova’s refund right] would trigger a standard version of this clause,” Brogan Law founder and managing attorney Aaron Brogan, who has worked on more than a dozen token fundraising deals, said. Brogan also said the applicability of MFN rights can depend on if the investor received tokens or equity.

According to another attorney at a venture capital firm, who declined to be named, the triggering of an MFN clause could also depend on other factors, such as if Brevan Howard Digital’s fund agreed to provide other services beyond investing, which could be used to justify additional rights. (That could be a plausible explanation for the reference to “commercial agreements” in Smokey’s statement.) But the attorney mentioned that absent such an arrangement, or a wide disparity in the amount of money invested, refund rights for SAFT token sales were generally universally applicable.

The Investors Left Out in the Cold

Regardless of whether the refund right clause was illegal, the token’s tumble since TGE has been a blow to all Berachain VCs — especially Framework Ventures, the crypto venture fund that co-led the Series B alongside Brevan Howard Digital’s Nova fund.

Unchained has learned that by the end of the second quarter of 2025, Framework held 21,145,476 BERA tokens, which were acquired at a total cost of roughly $72.4 million. The average purchase price for those tokens was $3.42, meaning Framework would be down more than $50.8 million on that stash of BERA at current prices. Framework Ventures did not return multiple requests for comment.

Other investors in Berachain’s $100 million Series B fundraise would also be underwater on the deal, assuming they invested at the reported $1.5 billion valuation. BERA’s FDV was roughly $526.7 million at press time.

Bearish BERA

The refund right could have become a moot point if BERA had performed well post-launch, since it would have been in Nova Digital’s interest to hang onto its BERA. Unfortunately for Berachain, that has so far not been the case.

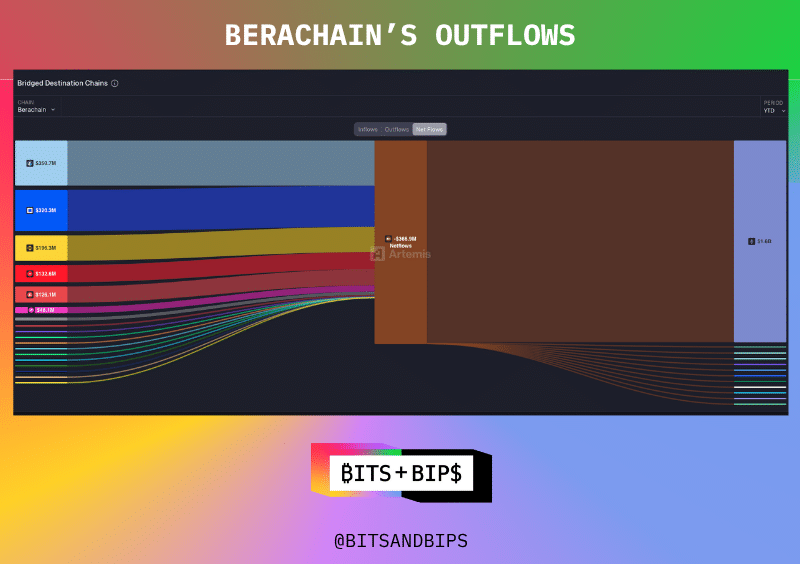

BERA is trading near an all-time low at $1.02, a third of the $3 per token at which Nova Digital invested. Berachain has also seen roughly $367 million in net outflows to other blockchains in 2025, according to Artemis, as of last Friday.

(Artemis)

Berachain’s technical co-founder, Dev Bear, is no longer at the project, two sources familiar with the matter said. Dev Bear did not return a request for comment.

Berachain’s validators also halted the network on Nov. 3, after a code bug in the DeFi protocol Balancer put some funds in Berachain’s native DEX, called BEX, in danger. Berachain resumed operations a day later and was able to retrieve the $12.8 million in vulnerable funds from a white hat hacker.

In recent months, several apps that launched on Berachain have also shut down or expanded to more hyped blockchains such as Hyperliquid, BlockHunters co-founder Ioachim Viju, who self-produced a documentary called “Straight Outta Berachain,” told Unchained. Viju gave IVX and Memeswap as examples.

Today, “there is very, very little [Berachain] community,” Viju said. Berachain-related X spaces, which were once vibrant digital forums, now struggle to attract more than a couple of dozen people, he added.

“I want to make it clear that Berachain, and especially Smokey, had a massive impact on my personal growth and my business. I wouldn’t be where I am today without Berachain,” Viju said.

“Of course, mistakes were made, even Smokey admitted they probably shouldn’t have sold so much to VCs. But at the end of the day, he’s still here, showing up for the community and working hard to onboard real businesses into Berachain.”

Revenge Arc?

As usage metrics stagnate and the months tick down until Nova Digital’s refund right deadline in February 2026, Berachain is trying to change the narrative.

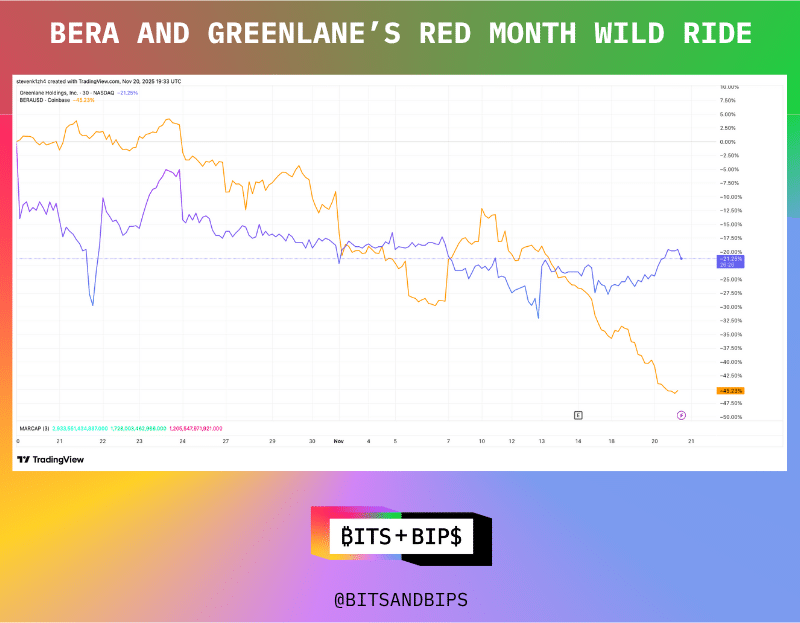

On Oct. 20, the smoking accessories, vape devices, and lifestyle products company Greenlane Holdings announced a $110 million private placement to begin acquiring BERA for a digital asset treasury (DAT) company. The DAT drew funding from investors including Polychain, Blockchain.com, Kraken, North Rock Digital, CitizenX, and dao5, according to a press release.

Polychain, which is one of Berachain’s venture backers, announced its intentions to add two members to a six-person board for the company at closing and two more pending stockholder approval in a form filed with the SEC. Berachain co-founder Papa Bear is set to serve as an advisor to the company, according to a pitch deck attached to the SEC filing.

Berachain’s founders have “some combination of too much accountability and pride” to “quiet quit” after its TGE, Smokey the Bera recently wrote on X. “Bera revenge arc loading,” he added.

After briefly climbing past $4.50 on the BERA treasury news, Greenlane’s stock had fallen to around $3.19 by Friday afternoon, as BERA also shed value.

(TradingView)

During an onstage interview around this year’s Token2049 conference, Smokey the Bera was asked how apps and founders can make it in the crypto industry.

His advice? Don’t chase narratives, create your own.

“And what is a narrative?” Smokey continued. “I think it’s mostly bullshit to be quite honest. It’s a bunch of people saying the same thing a bunch of times.”

Casey Wagner contributed reporting.

Privy Has a New Competitor?

– Juan Aranovich, managing editor of Unchained

Earlier this month, I was at a residency in San Martin de los Andes, Argentina, for human.tech, an open community to establish digital natural rights to privacy, security, and data ownership.

What really struck me was how deeply they’re thinking about the human side of technology. They’re deeply focused on building tools that actually help people.

They've just made a big announcement at WalletCon.

On Thursday, they launched Wallet-as-a-Protocol (WaaP), a new approach to wallet infrastructure that positions itself as an alternative to existing Wallet-as-a-Service (WaaS) options like Stripe-owned Privy.

So rather than it being a product, the wallet tech can be turned into a tech protocol, similar to how TCP/IP powers the internet. The pitch is:

One wallet across apps, instead of fragmented logins

2PC-based key management, with support for onchain policy controls

Recovery options without seed phrases

A gas abstraction layer to sponsor transactions across chains

It’s free to integrate, and already live in a few apps with a reported 2M+ users.

Whether this catches on will depend on adoption. Privy is already widely used and Stripe-backed, with a big head start. WaaP will need to match that ease of integration while convincing teams it’s worth the switch.

Still, it’s an ambitious swing and an interesting attempt to push wallets closer to being public infrastructure rather than siloed SaaS products.

Related content:

Reply