- Bits + Bips

- Posts

- Bitcoin Mining Stocks Are Outperforming DATs. But Is It a Good Sign for Bitcoin?

Bitcoin Mining Stocks Are Outperforming DATs. But Is It a Good Sign for Bitcoin?

AI demand is causing stocks to soar while mining profitability sinks.

Bitcoin mining has always been a cutthroat industry, with competitors constantly ponying up hundreds of millions or billions of dollars to procure new hardware in order to keep up with an expensive arms race.

For a long time they had no other choice, but the demand for HPC services has created a massive source of new demand for capacity.

And in the words of one analyst, just about everyone is being seduced by the promise of AI.

Today’s newsletter is brought to you by Mantle

Mantle is building the Blockchain for Banking — where TradFi meets Web3. Explore real-world financial tools, powered fully on-chain.

Bitcoin Mining Stocks Are Outperforming DATs. But Is It a Good Sign for Bitcoin?

Bitcoin miners are moving into high performance computing as demand grows and mining profitability drops. But once they shift towards AI they may not come back.

Are bitcoin miners about to say bon voyage to the U.S.? (ChatGPT)

During the 2024 presidential campaign, Donald Trump said that he wanted all future bitcoin to be mined in the U.S. As president, he has certainly tried to make good on that promise as he’s cozied up to the industry, down to his sons Eric and Donald Jr. launching their own bitcoin mining firm.

However, perhaps an even bigger priority for the U.S. — AI demand — could be forcing the industry abroad, according to one analyst.

“The AI market is very constrained and the U.S. has the infrastructure to support data center operators that a lot of regions internationally just can't,” said John Todaro, managing director at Needham and Company. “If we look at it on a global scale, you're going to see more mining find its way into the low power cost regions. You're just not going to see it as much in the U.S.”

While more bitcoin mining moving abroad is not necessarily a negative development for the industry, and less competition could improve mining’s razor-thin margins, it could make some of the country’s flagship firms beholden to the AI bubble, and it is unclear what might happen to them if the bubble bursts.

Why Bitcoin Mining Stocks Are Soaring

For much of their existence, bitcoin miners have been the unsung workhorses of the industry. Even during bearish periods, such as the 2022 crypto winter, firms invested billions of dollars in new hardware and infrastructure to support the network. These investments continue today even as bitcoin mining’s profitability remains near all-time lows and the hashrate keeps setting new highs.

(Luxor)

(Bitcoin Magazine)

Given these challenging economics, plus the added competition from exchange traded funds (ETFs) and a new wave of digital treasury companies that stockpile bitcoin in the capital markets rather than server warehouses in remote regions of the world, it's no surprise that bitcoin miner stocks have struggled in the past.

But it's a whole new world now. Given the insatiable demand for turnkey warehouses and power sources, Todaro said that bitcoin mining companies have been upgraded to the extent that they are now being analyzed as high-performance computing companies that support artificial intelligence large language models like OpenAI. “Most of the Bitcoin miners have re-rated and the market is willing to pay 15x, 20x, a 2028 EBITDA multiple. And as a sell side analyst, that's also where we're starting to target the ranges of valuation for these companies.”

Todaro said that these multiples are as high as he can ever remember and they stand in stark difference to how the equities rating industry sees pure play bitcoin miners. “We don't have many firms that are doing just bitcoin mining, so you don't even have a pure play comp anymore necessarily,” he said. “But a few months ago you had a couple that were mostly still focused on Bitcoin mining [such as Cleanspark and MARA] and those valuation multiples could get as high as 8 in a good month and 4 in a bad month. There's a big multiple discount between being a pure play bitcoin miner versus converting that capacity to support AI workflows.”

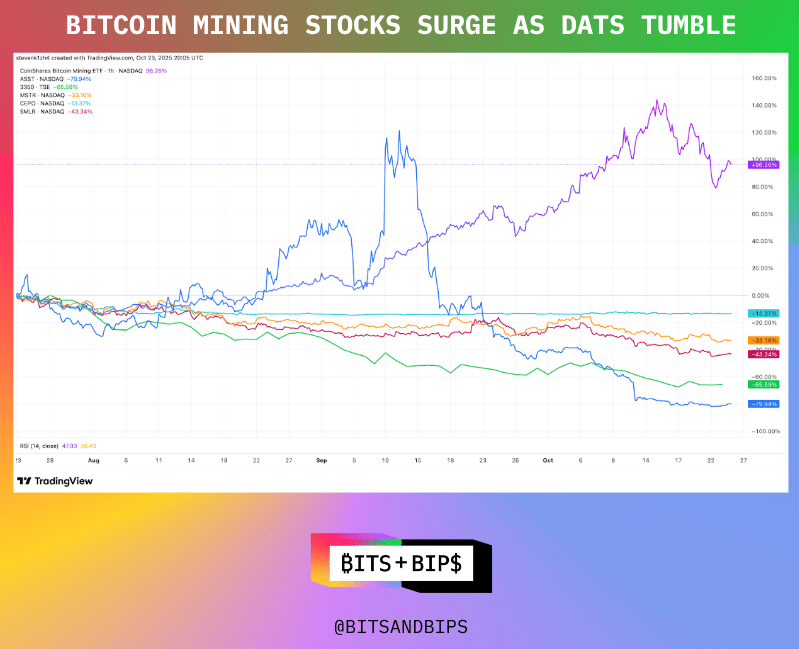

This shift in investor mindset is even more stark when compared to the performance of bitcoin DATs over the past few months, which are languishing. Over the last three months, Coinshares’ diversified mining ETF (WGMI) is up 96.26%, while virtually every major bitcoin DAT is down over that period of time.

(TradingView)

Why Bitcoin Miners Might Be Tempted to Switch to AI

Given these trends it might seem irresponsible for bitcoin miners, no matter how ideologically committed they are to the industry in the long term, to ignore HPC opportunities. But Todaro points out that the decision to move into this sector is not one that can be easily reversed.

“You're looking at a 20x difference in capital expenditures between building a tier 3 data center that could support AI workloads and a Bitcoin miner,” he said. “Your return on capital is not going to be there after a year or two to go switch to Bitcoin mining. Not to mention that these contracts are longer-dated. And so even if you wanted to switch back, you can't.”

The economics for HPC computing are also far more attractive. Unlike having to fight with an ever-growing network of hashrate for the 450 bitcoin mined every day, HPC data centers secure contracts with 10- to 15-year durations of steady revenue. And Todaro says that the margins are eye-watering. “Most of these guys are expecting 75-90% margin, and then there's also just that transparency of knowing that's what I'm going to get over the next 10 to 15 years. That margin is just so much better than bitcoin mining.”

Why Miners May Not Jump to AI

But this strategy is not without risks.

Industry watchers have been warning for months about an AI bubble, crying wolf that the trillions of dollars being raised to support infrastructure buildout throughout the world are writing checks that are yet to be cashed. What happens if one of the clients that signs a long-term with one of these firms goes belly up?

“Really the only risk is if the customer you signed for that lease capacity, if they go bankrupt, if they go bust,” said Todaro. “Obviously all these guys want to sign an investment grade hyperscaler [a very large cloud software provider] because the odds of Google, Microsoft, Amazon going bankrupt in that period, very low. But some of these smaller neo clouds, which are cloud service providers customized for AI use cases, maybe there's an increased chance of that.”

But perhaps as a sign of the times, Todaro said that even some of the neo clouds are getting backstopped [financially backed] by the major hyperscalers. As examples he points to deals that Fluidstack (an AI cloud platform) did with Cipher Mining and TeraWulf, which are actually being backed up by Google for the first five to six years. “There's a lot of these guarantees coming in from the major hyperscalers to make it where it's unlikely that someone's going to get out of the contract in 5, 10 years’ time. Once these data centers go for Bitcoin mining, you got the contract in hand and then you build a completely new data center that's going to not go back to Bitcoin mining at least for 15 years.”

So what about Bitcoin mining? Todaro’s best-case scenario is, “You eventually get sort of an equilibrium. If we just take a step back and assume all mining was done in the U.S., for instance, if miners in the U.S. transition to HPC, that's going to improve the market share of bitcoin mining and the profitability is going to expand.”

Related content:

Reply