- Bits + Bips

- Posts

- Crypto Asset Manager Grayscale’s ETF Chief to Depart Months Before IPO

Crypto Asset Manager Grayscale’s ETF Chief to Depart Months Before IPO

Grayscale has struggled to diversify its ETF business beyond bitcoin and ether. Now it needs a new captain.

Questions are already swirling around the outlook for Grayscale’s IPO given its reliance on two very expensive products, its bitcoin and ether ETFs. Now the asset manager is losing the person brought on to spearhead its ETF business.

Today’s newsletter is brought to you by Mantle

Mantle is building the Blockchain for Banking — where TradFi meets Web3. Explore real-world financial tools, powered fully on-chain.

Crypto Asset Manager Grayscale’s ETF Chief to Depart Months Before IPO

David LaValle, the company’s global head of ETFs, is leaving the company just months before it is set to IPO.

(Shutterstock)

Grayscale’s global head of ETFs, David LaValle, is set to depart the crypto asset manager at the end of July, according to a source familiar with the company’s operations.

LaValle came to the company in July 2021 as it was facing a key inflection point. The firm’s flagship product, its Grayscale Bitcoin Trust, had around $25 billion in assets at the time, making the company the largest crypto asset manager in the world. But the company was facing investor angst, and in some corners a revolt, because the product’s large premium markets had flipped to a discount that would not evaporate, until it finally got the Security and Exchange Commission’s (SEC) blessing to convert the product into an ETF in 2024.

According to the source, while much of the attention surrounding GBTC’s conversion focused on the company’s legal battle with the SEC, LaValle played an important role behind the scenes in lining up launch partners, authorized participants, and performing other key background duties to prepare for launch.

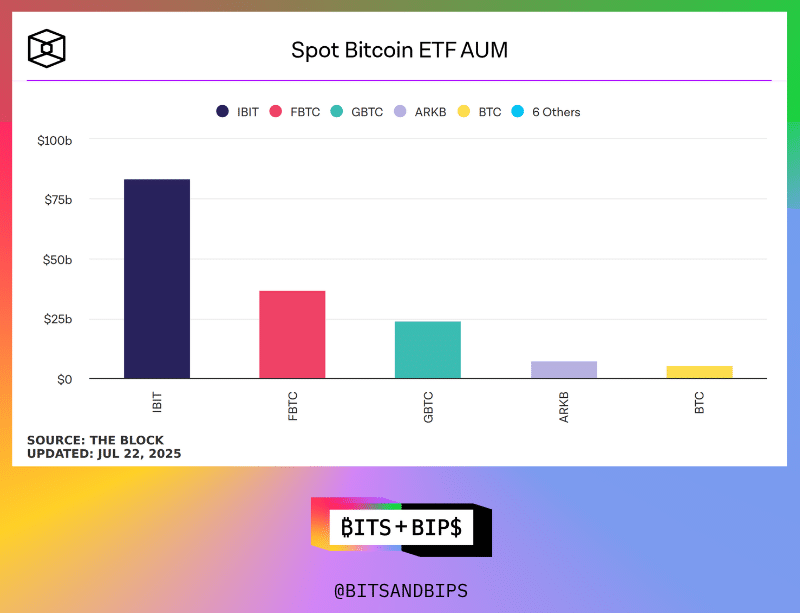

That said, the hard-won legal battle was in some ways a pyrrhic victory, as in the ensuing year-and-a-half Grayscale has since lost the title of world’s largest crypto asset manager to BlackRock, which has $83.3 billion in its bitcoin ETF. GBTC is down to $23.87 billion.

(The Block)

A Big Hole Ahead of Its IPO

LaValle’s impending departure is the latest in a series of leadership changes at the company. Its longtime CEO Michael Sonnenshein left the firm in May 2024 to make way for Peter Mintzberg in August of that year. Then in April 2025 the company hired Diana Zhang as chief operating officer to replace Hugh Ross, who had served in this role since February 2021.

But, LaValle’s move is the first to come after the firm confidentially filed for an IPO on July 14. A lawyer familiar with the confidential IPO process told Unchained that companies typically go public 3-6 months after such a filing.

A key question being asked around the industry is what growth story Grayscale will tell to potential investors. The crypto asset manager generates the majority of its income from its bitcoin and ether products, but they are priced at 1.5% and 2.5%, respectively, and are struggling to gain new funds because they’re comparatively quite expensive.

For instance, BlackRock charges 0.25% for its product. But that has not stopped its bitcoin ETF, IBIT, from becoming the $11.5 trillion asset manager’s most profitable ETF.

A Grayscale representative and David LaValle did not respond to requests for comment.

Related content:

Reply