- Bits + Bips

- Posts

- Crypto Q3 Earnings: Coinbase Goes All In on Stablecoins + Strategy Looks Abroad

Crypto Q3 Earnings: Coinbase Goes All In on Stablecoins + Strategy Looks Abroad

They’re performing well but aren’t resting on their laurels.

Coinbase and Strategy are driving forces for the crypto industry. One is in the S&P 500 and the other is the progenitor of the entire digital asset treasury (DAT) industry. Both reported earnings last night, and while each revealed positive growth, the bigger story to me is where they are looking to go next.

Before we dive in, I want to hear from you!

Let me know the stories you want covered through a quick survey.

Today’s newsletter is brought to you by Mantle

Mantle is building the Blockchain for Banking — where TradFi meets Web3. Explore real-world financial tools, powered fully on-chain.

Crypto Q3 Earnings: Coinbase Goes All In on Stablecoins + Strategy Looks Abroad

In its first earnings report post GENIUS Act, Coinbase looks to build on its record USDC growth. Meanwhile, Michael Saylor dismisses dwindling mNAV premiums.

Brian Armstrong and Michael Saylor both report strong earnings (ChatGPT)

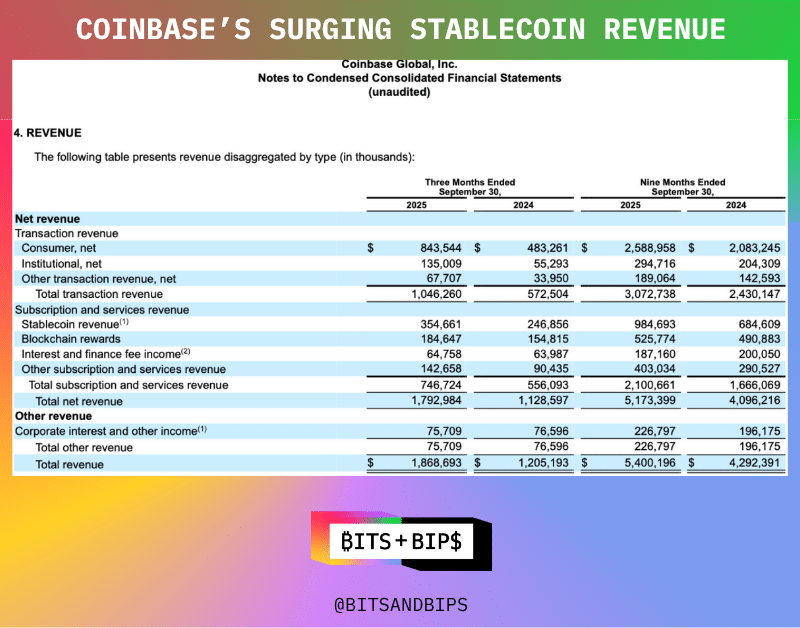

By all accounts Coinbase had a very strong Q3. It posted strong top- and bottom-line numbers across the board (see below).

Transaction numbers were up, though these were aided by the fact that the firm closed its multibillion acquisition of the options platform Deribit in August, and when I spoke with Chief Financial Officer Alesia Haas Thursday afternoon, she also sang the praises of a new white-glove concierge service for the company’s most lucrative traders. (A little known secret in the crypto world is that exchanges will bend over backwards to cater to their whales. In that sense, they are like casinos without the free hotel suites.)

(Coinbase)

But what really stood out to me was the growth of USDC on the platform. It should not be too much of a surprise given that the GENIUS Act, a stablecoin-focused bill, is the first piece of major crypto legislation to become law. But these results speak to the excitement about stablecoins in this new age.

Coinbase Powers USDC

So here are the numbers. For those of you who do not know, Coinbase has a revenue sharing agreement with Circle, the primary issuer of the $74 billion USDC stablecoin. (The joke in crypto circles is that Coinbase makes almost 10x as much money from USDC as does Circle because they get to share in the fees that come from investing the collateral, while Circle has to pay all of the expenses.)

And this quarter the company earned $354.7 million in revenue from its partnership with Circle, making it by far the largest component of its subscriptions and services business, which totals $747 million. That is the highest result for this category of income in the company’s history, according to Haas.

(Coinbase)

Coinbase remains the largest distribution agent in the world for Circle, with $15 billion of the asset sitting on its platform. Aside from generating significant yields from these holdings, USDC is a major enabler for much of what else Coinbase is trying to build, as it evolves into what it described last quarter as the Everything Exchange. This means letting people trade anything they want, from crypto tokens to meme stocks and NFTs — even betting on prediction markets, though Haas said that she did not have anything new to report on that front.

And in commentary from executives and stock analysts, along with other news this week, it is clear that stablecoins and payments are the new frontier.

Citigroup just announced a partnership with Coinbase to pilot stablecoin payment services, allowing institutional clients to move seamlessly between fiat and crypto. Citi’s head of payments, Debopama Sen, said clients increasingly demand programmable, 24/7 payment systems as the bank projects a $4 trillion stablecoin market by 2030.

Coinbase also deepened its ties to traditional finance through a second partnership with Apollo Global Management to expand stablecoin-backed lending and tokenized credit products.

Embedded, Agentic Commerce

Haas also noted that the company is working on what she described as agentic commerce, where crypto native functionalities, such as payments, will be seamlessly embedded into websites and apps, including many on Coinbase’s dedicated L2 blockchain, Base. Mark Palmer, senior equity research analyst at Benchmark, agrees:

“One of the big differences here between what Coinbase previously did with payments with Coinbase commerce [a merchant payments platform] and its current initiative is that Coinbase commerce was about enabling merchants to accept crypto for payment, which frankly didn't take off to the extent that some had hoped, at least not yet. But its current initiative is really more about what in FinTech they describe as embedded finance, the idea of adding a FinTech related module to a non FinTech e-commerce site or other online platform. And that's where Coinbase is able to apply its engineering expertise and to serve in the very important role of integrating crypto capabilities into a broad variety of different businesses.”

The company still has some headwinds to navigate. For starters, significant new competitors from the likes of Stripe and Tether are building their own blockchains for payments. Even potentially Circle, which is building a payments blockchain as well and just released its mainnet beta. On the Circle front, the good news for Coinbase is that its highly lucrative deal will renew in perpetuity unless the company actively stops supporting it. Part of me wonders if Circle will ever try to get out of the deal or renegotiate terms.

A Tiny Base

For Coinbase to keep up with all of this innovation, I think that it will be incumbent upon them to continue to support usage of the Base platform and its newly devised Base app. One element of Coinbase’s product offerings that was not mentioned very much this time around was Base itself, as it still contributes very little from a financial point of view.

“In terms of revenue contribution, [Base sequencer revenue] is still very minimal. So based on my methods, I think it's still less than 1% of total company revenue,” said Owen Lau, managing director at Clear Street. “Therefore, I think they’ll try to put more emphasis on the Base app right now as opposed to the Base [chain] itself. I guess they have to go in parallel.”

Saylor Sets Course Abroad

In terms of Strategy, I was very interested to hear how Michael Saylor was going to address declining premiums for digital asset treasuries (DATs), many of which have flipped negative. Some of the most prominent bitcoin DATs like Strive and Nakamoto are down over 90% from their highs. Strategy’s premium is still positive, at 1.09, but it has been declining for over a year.

Mark Palmer also covers Strategy, and I was able to catch up with him after the earnings call. Here are his key takeaways.

Saylor continues to believe that the company’s premium will rebound and grow in the future.

He remains committed to lowering the use of leverage — in fact, he wants all convertible debt to be retired by 2029 so that the company is no longer at risk of having to liquidate capital.

He intends to continue pressing the company’s advantage as the only firm that has been able to sell preferred perpetual stocks, which fetch higher prices than common shares and thus allow for greater bitcoin yield results, especially abroad. A few countries/areas that Saylor is going to focus on are Canada, Europe, and Latin America.

But most interestingly, Saylor noted that he is not interested in buying or engaging in M&A with any of the struggling aforementioned DATs. He believes in having a clean balance sheet, and acquiring any of these firms would either import a lot of new leverage (convertible debt) or force him to negotiate with investors on a way out. Palmer said that Saylor also made it a point to note that deals of this nature can take 6-9 months to complete, and by then these screaming bargains may not look so appetizing anymore.

This orthodoxy to Strategy’s strategy (pun intended) is a major reason why the company is seen as a leader in the industry, and he does not seem interested in deviating from the course.

Related content:

Reply