- Bits + Bips

- Posts

- Crypto Treasury Stocks Are on Sale. Is Now the Time to Buy?

Crypto Treasury Stocks Are on Sale. Is Now the Time to Buy?

These assets are ultra cheap — but they are risky

I have been watching premiums for digital asset companies recede below 1 over the past few months. Put another way, they could be seen as a cheaper way to buy bitcoin or ether than the already discounted spot prices. Now, instead of paying a company $2 to buy $1 of bitcoin, you could theoretically buy $1 of an asset for 50-75 cents.

Seems like a great deal right?

I wanted to find out, so I decided to look into the mechanics behind these discounts and what it would take for them to get back to par. In the first part of the article, I will go over the recent performance of these companies and explore the history of crypto assets trading at discount. But at the end, I analyze exactly what needs to change and whether this is a perfect buying opportunity, or a waste of one’s capital…

Today’s newsletter is brought to you by Mantle

Mantle has entered a new phase as the distribution layer connecting TradFi and onchain liquidity. To accelerate this vision, the Mantle Global Hackathon 2025 is inviting developers to build scalable RWA and DeFi products.

Why build on Mantle? It’s an ecosystem built for builders. You get direct access to Bybit’s 7M+ users for potential listing exposure, support from the $4B Mantle Treasury, and mentorship from top VCs like Spartan and Animoca Brands.

With 6 tracks—prioritizing RWAs and RealFi—and a $150,000 prize pool (plus grants), this is your chance to deploy on a high-performance modular L2.

Mantle is building the Blockchain for Banking — where TradFi meets Web3. Explore real-world financial tools, powered fully on-chain.

Crypto Treasury Stocks Are on Sale. Is Now the Time to Buy?

History shows upside, but without easy arbitrage, risks remain high.

Bitcoin and Ether are down, but their DATs are even cheaper (ChatGPT)

Key Takeaways

As bitcoin and ether slide sharply from recent highs, investors are looking at value plays in the market. Digital asset treasury stocks, which are now trading at hefty discounts, represent an intriguing opportunity.

The article explores whether these sub-1.0 mNAV valuations represent a GBTC-style opportunity or a value trap.

Digital asset treasury stocks have flipped from trading at large premiums to deep discounts, with many now valued well below their underlying bitcoin or ether holdings.

While history shows discounts like these can create outsized long-term returns, most DATs lack a clear mechanism to close the gap, meaning mispricings can persist or worsen.

Share buybacks and yield generation, especially for ethereum treasuries, may help support valuations but introduce leverage, liquidity, and execution risks.

Buying discounted DATs is not a clean arbitrage trade and works best as a long-term, high-conviction bet rather than a short-term dip-buying strategy.

As crypto continues to tumble, there is lots of talk about buying the dip. After all, bitcoin is down approximately 30% from its all-time high above $126,000 in early October and ether has fallen over 35% in the same time period.

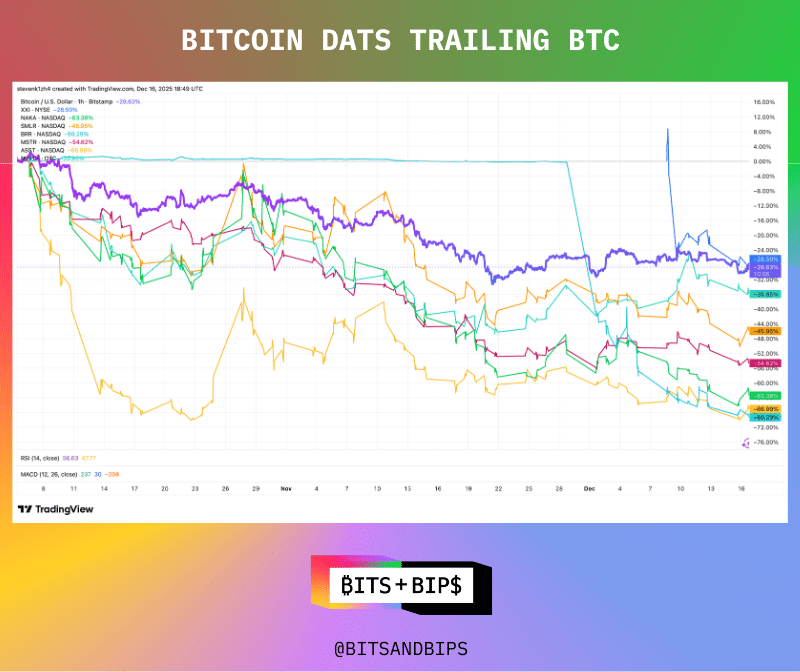

(TradingView)

These seem like great deals for the long-term crypto bull. But it may be possible to get exposure to these assets at even bigger discounts — purchasing equity in digital asset companies stockpiling these assets.

These firms, known as digital asset treasuries (DATs), exploded this year, copying the playbook created by Strategy Chairman Michael Saylor five years ago to accumulate over $150 billion worth of bitcoin and $17 billion worth of ether. And for most of the spring and summer these companies traded at massive premiums to the value of their underlying crypto holdings.

Essentially, they were getting investors to give them $2 for every $1 of bitcoin in a race to acquire the biggest stockpile possible. Investors were in turn hoping to benefit from a flywheel effect created by concurrent increases in crypto and stock prices, along with new sets of investors buying in at even higher premiums.

But nothing lasts forever, and these firms have crashed as part of this market downtrend.

“You could put whatever fancy wrappers on it you want, but bottom line is the best analogy for a digital asset treasury company is a closed mutual fund that's willing to issue a lot more shares when times allow,” said Steve Sosnick, Chief Strategist at Interactive Brokers, in an interview. “But the bottom line is it's a pretty straightforward business. It stretched the imagination to think that [2-3x multiples] are sustainable. It was a money machine.”

Virtually every major DAT focused on these assets is now trading at a discount, meaning that its premium (mNAV) is below 1.0. Essentially, investors now think that these companies are worth even less than their crypto holdings. Many are trading at discounts of almost 50% the value of their holdings (see Key Figure).

Almost all have also dramatically underperformed their reference assets since early October.

(TradingView)

(TradingView)

These dynamics beg the following questions for investors:

If markets are poised to eventually rebound, is it smart to buy these stocks to earn even higher returns than spot?

Is the natural equilibrium for DAT premiums to be around 1? If so, do these massive discounts represent a unique arbitrage opportunity for investors?

Key Background

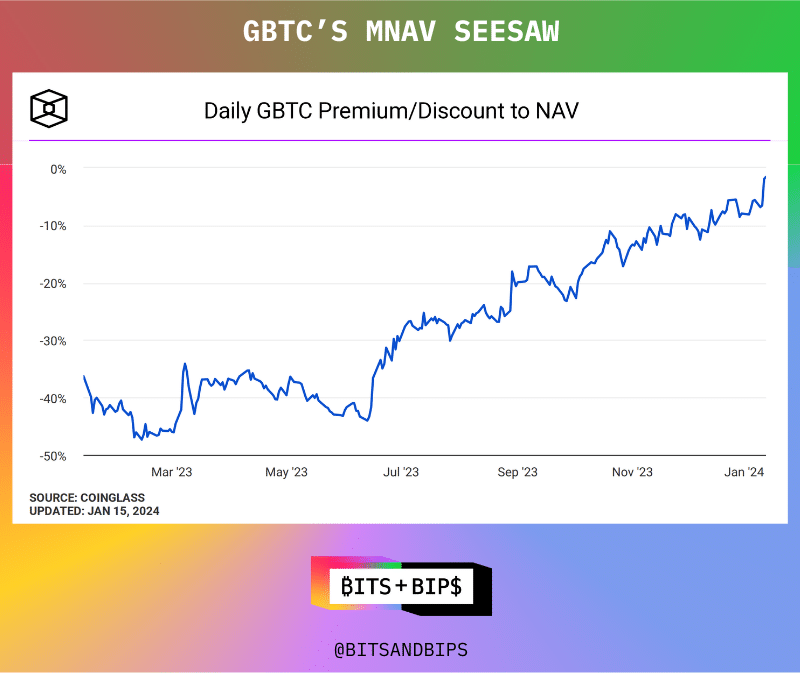

In the past investors have taken advantage of these types of discounts to make big money. From February 2021 to the beginning of 2024, the Grayscale Bitcoin Trust (GBTC), which now trades as an ETF on the NYSE Arca exchange, traded at a discount to its net asset value (NAV) that almost reached 50%.

(The Block)

It fell so low for a few reasons. First, before the trust was able to convert to an ETF, it also operated like a closed-end mutual fund. That means that while investors could buy shares at NAV, they would be able to trade freely at premiums or discounts once issued. The closed part comes in because investors have no way to redeem shares for the underlying collateral.

GBTC was crypto’s version of Hotel California.

For years (GBTC first launched in 2013), the asset traded at a lofty premium that topped 100%. A major reason was the lack of other regulated alternatives for investors to get access to crypto, particularly if they did not want to custody the crypto themselves.

But, the premium flipped to a discount when the first bitcoin ETF launched in Canada (which allowed redemptions) and the discount continued to grow during the crypto winter of 2022 when many prominent firms such as Three Arrows Capital, Genesis Trading, and BlockFi, went bankrupt and the price of bitcoin tumbled below $15,000.

But even when bitcoin started to recover in 2023, the discount persisted, largely because GBTC shareholders could not redeem their discounted shares for full spot-price crypto. It was an illiquidity discount. Eventually Grayscale won a lawsuit against the SEC in October 2023 that made it a fait accompli that the asset would be allowed to convert into an ETF, thus enabling arbitrageurs to zero-out the discount.

Opportunistic investors who bought GBTC shares at the massive crypto discount reaped major rewards on top of the spot price appreciation.

Key Figure

Here is a list of prominent bitcoin and ethereum DATs and their respective mNAVs (NAV multiple), the metric that tells you the premium or discount placed on a stock. Some of the numbers look very similar to those faced by GBTC during the 2022 crypto winter. On the bitcoin side, the three lowest are Cantor Equity Partners, KindlyMD, and Semler Scientific. But the lowest mNAV among companies tracked is Ether Machine, trading at an mNAV of .13.

An investor can interpret these numbers as how much shareholders value the company vis-a-vis its crypto holdings. An mNAV below 1 means that the company is worth less than its actual crypto.

(Unchained)

Will GBTC’s history repeat itself? It depends.

But first it is necessary to determine the natural equilibrium for these products. Unlike an ETF, the answer is not necessarily 1, but it could be close. “I don't know what the right premium discount level is, but it's not multiples,” said Sosnick. “You can argue that if they are able to generate yield from these assets, maybe you should pay a small premium.”

Zach Pandl, Head of Research at Grayscale Investments, agrees. “From an analytical standpoint, in the longer term, mNAVs should be near 1, plus or minus. In private credit, these products will typically trade at a discount to account for the management fee in the product. On the other hand, if the digital asset treasury companies are able to use sophisticated financing sources and to generate more return from their assets in some way that is not available in other structures than conceptually, they could trade slightly above 1 in the longer term.”

And the underlying tokens differ from each other. For instance, ethereum, which can be staked, is considered to be a productive asset. Bitcoin does not have this native functionality. “Ethereum treasury companies can use staking and then restaking to generate additional revenue,” said Fedor Shabalin, a research analyst at B. Riley Securities. “Sharplink Gaming recently reported third quarter earnings where it showed over $10 million of revenue just from staking. Bitcoin doesn't generate yield as a nature of the coin.”

How Can These DATs Return to an mNAV of 1?

But getting back to an mNAV around 1 for these products is not simple. After all, investors have no pathway to buy shares in the company and ask for their proportional amount of crypto like authorized participants in an ETF.

“The DATs need to have a mechanism to close the gap. With GBTC and ETHE (Grayscale’s Ethereum trust), you had a line of sight to ETF conversion,” said Ram Ahluwalia, founder of Lumida Wealth, in an interview. “Some of these DATs don't have a legal mechanism to close the gap, and some of them expressly prohibit them from selling their tokens to buy back their stock.”

Ahluwalia also made another key point about the different circumstances between today’s market and 2022. “For GBTC and ETHE, the lows in those assets were behind us [by the time of the ETF conversions in 2023]. The presence of discounts alone don't mean you just go buy them. We had discounts in GBTC in 2022, and the spreads kept widening.”

This warning is particularly important as market sentiment remains bearish and some analysts are warning of further drops in the price of crypto. One even hypothesizes that bitcoin could drop to as low as $25,000. If history is any guide, these DATs will continue to underperform their reference assets during such periods of investor angst.

As demonstrated in the chart below, bitcoin briefly regained some bullish sentiment last week, particularly in the immediate hours after the Federal Reserve dropped its targeted federal funds rate by 25 bps, but its momentum has since stalled as fears of a multi-month downtrend are starting to form without a positive catalyst in the near term.

(TradingView)

Action Items

Investors seeking value in these companies need to be clear on the specific timeframe that they are targeting with their investment. While it seems logical to assume that almost every DAT will eventually settle on an mNAV around 1, absent a major driver like a hack, fraud, or poor investment, getting there will not be easy. It could take years and perhaps a lot of M&A activity and hostile takeovers that come with forced liquidations.

How DATs Try to Boost Their Flagging mNAVs, and Why Investors Should Be Careful

This is the kind of deep investigation that flags hidden risks and regulatory shifts before they affect your portfolio, helping you spot opportunities others miss.

Reply