- Bits + Bips

- Posts

- DeFi Tokens Surge — But These Hidden Gems Could Shine Next

DeFi Tokens Surge — But These Hidden Gems Could Shine Next

Degens are watching these emerging tokens during this new wave of DeFi growth.

DeFi is having another moment, as many of its blue-chip tokens have surged on the back of heightened enthusiasm around Ethereum and the GENIUS Act’s passage. I spoke to many investors who still see room for growth in these tokens because they will be the first point of entry for institutional investors new to the sector.

BUT, if you are looking to discover some hidden gems, there are some emerging tokens and projects out there that are yet to see similar price spikes.

Today’s newsletter is brought to you by Mantle

Mantle is building the Blockchain for Banking — where TradFi meets Web3. Explore real-world financial tools, powered fully on-chain.

DeFi is surging across the board, but some unloved tokens have not shared in the gains. Here’s why that could change.

Blue-chip DeFi tokens are jumping, but now others are getting ready to make the leap (ChatGPT)

DeFi tokens are having a moment. Aside from being a high-beta play on ether, which has surged 73.19% over the past three months to trade at $4,664, expectations are growing for a big influx of capital into the sector on the back of the GENIUS Act giving stablecoins the regulatory all-clear.

As of this writing, over $156 billion in assets is locked in various DeFi protocols like AAVE, Compound, Uniswap, and others. But with stablecoins now set to surge — Treasury Secretary Scott Bessent says that they can grow from their current base of $270 billion to over $3 trillion by 2030 — industry analysts expect usage of these protocols to climb as token holders seek passive yield on their assets.

Things could get even more frothy if the U.S. federal funds rate begins dropping later this year, as expected, because that makes DeFi-driven yields more attractive than the ostensibly risk-free rate offered by U.S. treasuries. “One interesting phenomenon is that if there's rate cuts in TradFi, the crypto credit spreads and onchain yields generally widen because it pushes up risk assets,” said Maple Finance CEO Sid Powell on a recent episode of Unchained’s Bits +Bips podcast. “If the borrowing rate on bitcoin goes higher, the yield you can get onchain goes higher.”

But everyone in crypto knows about the top tokens like AAVE, UNI, COMP, and CRV. And they are likely poised to still grow as first-time investors enter DeFi on top of their frothy last few months. “At this very early stage, everything should be considered under the radar from the standpoint of the broader investor community,” said Zach Pandl, head of research at Grayscale Investments, in an interview.

(TradingView)

But there are some other tokens lurking that industry insiders say are worth paying attention to as the market moves into the tail end of 2025.

ONDO — Onchain Yield

One feature, or perhaps flaw, in the GENIUS Act, depending on where one sits, is its prohibition on sharing the yield generated by stablecoin collateral with the actual token holders. This has led investors to look for other ways to create this extra stream of income.

One popular method is by purchasing tokens that invest in real-world assets, such as treasuries, that can exist onchain and be used for trading collateral or as a means of operating a corporate treasury. According to RWA.xyz, $6.6 billion of U.S. treasuries have been issued onchain. Some of these tokenized treasuries are operated by traditional asset managers like BlackRock or Franklin Templeton. But others are issued by DAOs, such as Ondo, which has $700 million in treasuries under management in its OUSG token (some which are backed by BlackRock’s BUIDL itself in a more retail friendly-wrapper) and $688 million in its yield-bearing stablecoin USDY.

(RWAxyz)

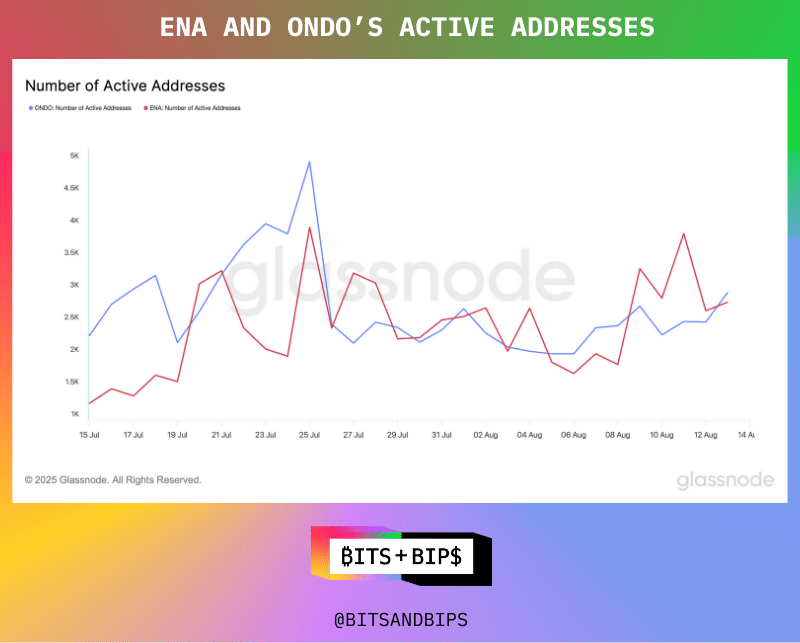

But here is why it could be flying under the radar. It is actually beating one of its bigger competitors, Ethena, which operates a similar yield-bearing stablecoin called USDe in terms of both active and new users.

(Glassnode)

(Glassnode)

But, over the last month, Ondo’s governance token has dramatically lagged behind its ENA counterpart, which is likely due to a few factors. Ethena’s synthetic dollar, USDe, has seen explosive growth as the yield went to two digits. The protocol also benefits from having a crypto treasury company, TLGY Acquisition Corp (TLGY), and is preparing to turn on its long-awaited fee switch, a move that could funnel a share of protocol revenues to ENA holders.

Valuation-wise, the two projects are now neck and neck: Ondo’s fully diluted valuation sits at around $10 billion, while Ethena’s is roughly $10.9 billion. But Ethena’s TVL is almost ten times higher at $11.14 billion compared to $1.37 billion. And in August alone, Ethena generated 10 times more protocol fees than Ondo.

“I definitely think ONDO is undervalued right now,” said Kavita Gupta, founder of the Delta Blockchain Fund, who suggested that the competition might only increase between these tokens, while there remains room for both to grow.

“I do think ONDO is going to go up, but there's a race between Ondo and Ethena. Every crypto native platform I talk to is including Ethena for better yields.”

(TradingView)

Morpho and Euler — DeFi Lending

Anybody who has followed crypto for a long time will be familiar with the blue-chip lending protocols like Aave, Compound, and Curve.

CRV grew particularly after the GENIUS Act was signed into law on July 18 because of its positioning as the major DeFi protocol for exchanging stablecoins. On the other hand, AAVE and COMP saw more muted growth.

(TradingView)

Every analyst that I spoke to suggested that both have more room to grow, but that two projects worth paying particular attention to now are Morpho and Euler. Morpho has $6.22 billion in TVL and has grown by 24.89% over the past 30 days, trailing only Aave in terms of major legacy DeFi lending protocols over that period of time. Euler hasn’t seen the same level of growth over the last 30 days, but it does boast an impressive 17.4% increase over the last seven days, showing some significant new momentum.

Morpho is particularly interesting because of its tie-up with private equity giant Apollo on a structured credit fund, something that I wrote about for Unchained in May 2025. Analysts that I spoke with suggest it could be positioning itself as a broader RWA platform.

(DeFi Llama)

Both of these tokens could offer attractive entry points for investors, especially when compared to a couple of other DeFi tokens that are also making noise. Spark (SPK) is the native governance token for the Sky-based lending protocol SparkLend. As demonstrated in the table above and the chart below, it has seen dramatic growth in terms of price and TVL. However, the token only launched in June, and like many new assets there is a lot of volatility in terms of price movement in relation to airdrop farming and other growing pains from getting off the ground. The asset is in the middle of substantial climbdown from an artificial high in late July.

JustLend (JST) is a Tron-based lending protocol whose price has continued to suffer despite heavy inflows as well. The Tron blockchain is in an interesting position right now because of its secretly high fees for sending stablecoin transactions, which account for most of the activity on its network, making it vulnerable to new stablecoin chains being launched by the likes of Tether and Circle. Questions about the level of decentralization on Tron could also make the blockchain less enticing for institutional users looking for DeFi exposure.

Finally, Maple (SYRUP) is another token worth watching that has seen some expansive growth, but at the same time, its token performance has far surpassed Morpho and Euler’s, especially when looking out over the last six months, perhaps making it more susceptible to a pullback.

(TradingView)

(TradingView)

Reasons for Caution

Invariably, when investors search afield for more yield, there can be extra risks as compared to the blue chips that have been around for years.

“I think that established DeFi players have an advantage in that there's a big barrier to proving that you're safe and can be trusted,” said Carlos Guzman, vice president of research at GSR. “The longer you're around, the less likely you are to suffer a smart contract attack because your protocol has proven itself to be resilient, and it has undergone multiple audits.”

For instance, Euler suffered a major hack in March 2023 that saw the project lose almost $200 million in crypto.

And it is not just security that can be problematic. In the past, Ondo has had to deal with concerns about token economics that favor insiders, and one expert that I spoke with for this article on the condition of anonymity worried that the fees earned by Ondo (0.15% - which won’t begin until Oct. 1, 2025) are relatively small and do not feed back into the ONDO’s token value itself. However, he did acknowledge that many major crypto assets, such as XRP, tend to trade more on sentiment than on solid fundamentals. And if nothing else, Ondo has strong branding value in the tokenized treasury market.

It is important to keep these extra considerations in mind when searching for extra yield, while remembering that crypto investors still see a lot of room to grow for the blue-chip assets.

“People will seek DeFi protocols to get leverage. And as the market is doing well, bullish sentiment pushes people to seek more leverage,” said Guzman. “So that increases the TVL of borrow/lend protocols for instance. It also increases volumes in decentralized exchanges.”

Related content:

Reply