- Bits + Bips

- Posts

- ETH’s Push for $4,000 Is Making Headlines, But Price Charts Favor XRP

ETH’s Push for $4,000 Is Making Headlines, But Price Charts Favor XRP

ETH is front-page news, but the bigger story could be what is happening with XRP.

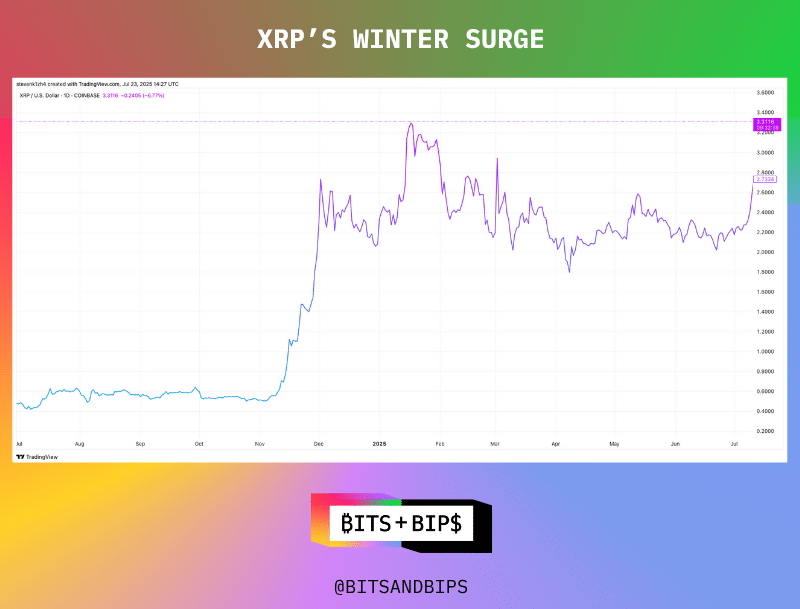

Anyone who has read my writing on Ripple Labs and XRP knows that I have a lot of questions surrounding their strategy and long-term market fit. But there is no denying that XRP has a loyal following, which is only growing after the asset hit another all-time high this month.

I wanted to speak with some experts to get a sense of where the market is now headed, and I was surprised to find that they were very bullish on XRP — despite sharing some of these same criticisms — while bracing for some ETH pullback.

They also shared some insight with me regarding which other tokens are primed to pump next quarter.

Today’s newsletter is brought to you by Mantle

Mantle is building the Blockchain for Banking — where TradFi meets Web3. Explore real-world financial tools, powered fully on-chain.

ETH’s Push for $4,000 Is Making Headlines, But Price Charts Favor XRP

$446.9 billion ETH is clearly having a moment, but one technical analyst says that XRP is getting ready for an even bigger run — despite just hitting all-time highs.

Is XRP primed to leave ETH behind? (ChatGPT)

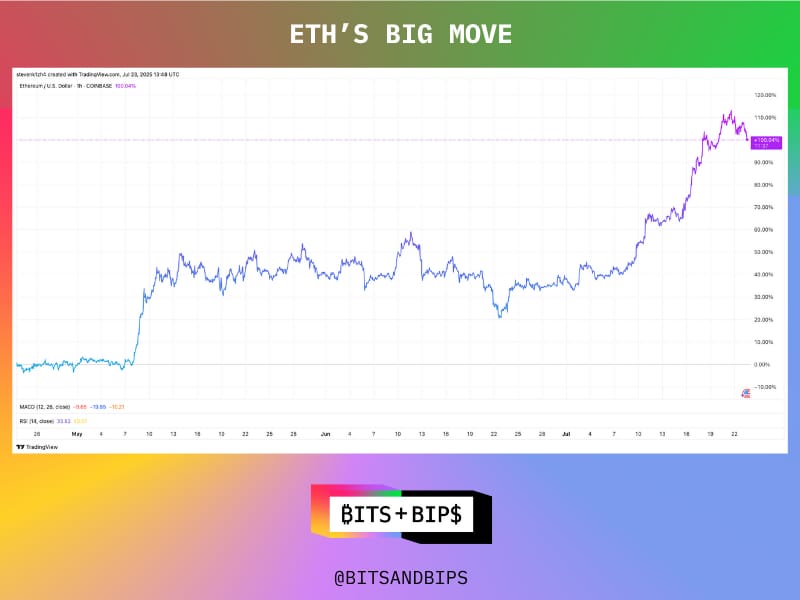

Ethereum (ETH) bulls are crowing. The asset has doubled in the past three months after spending most of 2025 trailing market leaders such as bitcoin (BTC), solana (SOL), and XRP (XRP). And for established holders, this move — which comes on the back of the GENIUS Act being signed into law and a growing swell of ETH-focused treasury companies — could not have come too soon.

“What we are seeing in crypto markets is that assets that are perceived to benefit from rising stablecoin adoption are outperforming,” said Zach Pandl, head of research at Grayscale Investments, in an interview. “The number one example is Ethereum. Ethereum hosts around half of all stablecoin balances and about 40% of stablecoin transactions.”

But, with Ethereum potentially hitting a point of exhaustion — currently priced at $3,601, it is down 7% in the last couple of days — multiple analysts say that XRP could be poised to surge.

These assessments are based on growing trends in its price charts and (perhaps misguided) retail enthusiasm towards the asset. Key questions surrounding the future of XRP such as how it fits in a world where Ripple Labs is now promoting its own stablecoin (RLUSD) have not been answered. On top of that, its native blockchain, the XRP Ledger, still sees limited usage.

But at the end of the day a significant amount of price action in crypto is divorced from fundamentals, and analysts say XRP could be ready to ride another wave of excitement.

(TradingView)

Multiple Bullish Catalysts for XRP

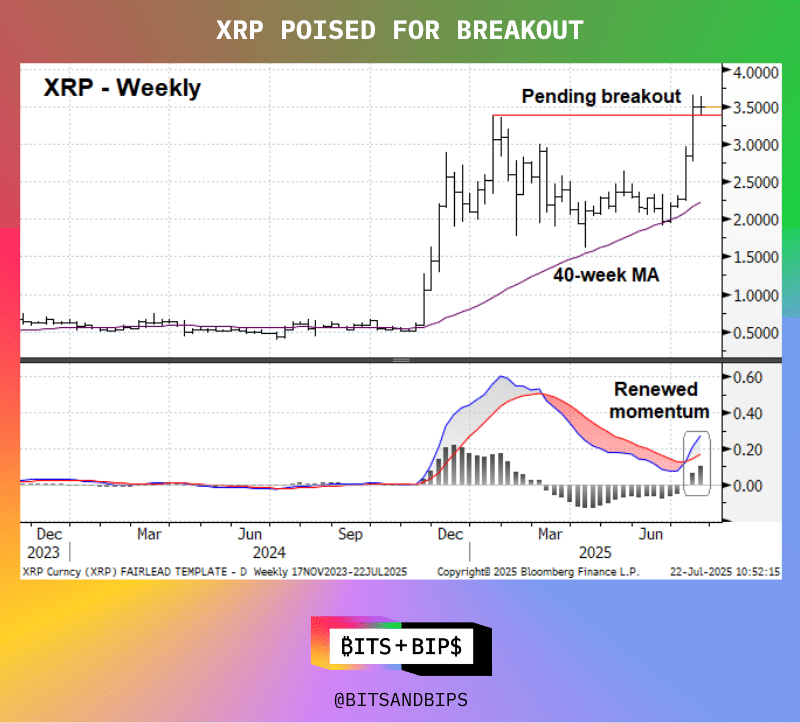

For starters, XRP’s technical chart is showing a bullish setup. “If XRP can close above $3.40 on Sunday, then that would confirm a breakout,” said Will Tamplin, senior technical analyst at Fairlead Strategies. “Assuming we see that breakout confirmed, that would be a bullish intermediate-term catalyst for XRP.”

The chart below also shows why momentum for XRP could push through this barrier, as the Moving Average Convergence Divergence (MACD), a technical indicator used to discover changes in momentum for a given asset, recently flipped positive on the weekly charts.

(Fairlead Strategies)

In comparison, Tamplin also pointed out that it might take more than just a positive tailwind from Washington, D.C., to push ETH into new territory above $4,000 in the near term.

In fact, he said that XRP’s chart looks better than ETH’s. “If you just look at the charts they favor XRP more than ETH. XRP has a long-term tailwind behind it with that uptrend. It doesn't mean that Ether is not getting in a long-term uptrend, but it's not establishing one right now,” said Tamplin.

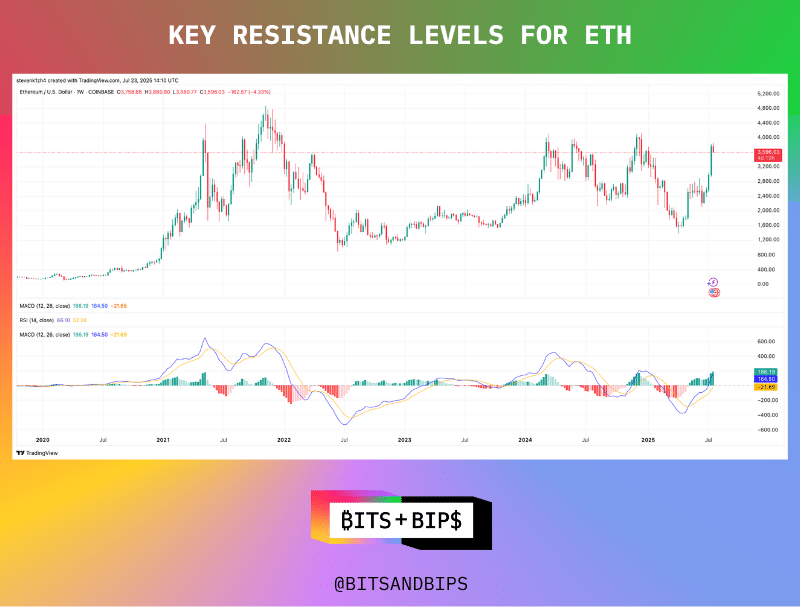

This statement is not meant to imply that ETH’s chart is looking bearish. It still has positive momentum, as demonstrated by its MACD, but it is also approaching a key resistance level of $4,000, which it has failed to break in three successive attempts in recent years. “It's a psychological threshold, and once it's established as a key point of resistance, then it kind of becomes a more meaningful level,” said Tamplin.

Additionally, some of the big OTC trades that set up ETH for this big run could be fading out. “A few weeks ago just before that really big move (in ETH) kicked off, we saw some really large option blocks trade for September to December expiries," said Jake Ostrovoskis, OTC desk principal at the crypto market maker Wintermute in an interview. “Ultimately they were big and chunky enough to get everyone in the market to take that rotation trade (out of BTC into ETH) a little bit more seriously. We then saw obviously a big follow through in ETH. Looking at the shape of the curve, there was a lot more buying in ETH than BTC up until about this week.”

(TradingView)

But that is not all, as XRP appears to have awakened animal spirits among its followers, who may not be as concerned with traditional financial valuation metrics or actual traction.

“Your traditional dino coins [like XRP] resonate very well with the retail crowd that was around 2021 and saw huge multiples,” said Ostrovoskis. “You've also got it benefiting from a low unit bias whereby people don't even look at the market cap, they look at what it's trading at on an actualized basis.”

This last comment refers to a trading fallacy in which investors might perceive an asset as inherently cheaper because its per-unit price is lower than a competitor’s, without considering the actual percentage of a market cap represented by that asset. It is the same reason why some companies perform stock splits when the price gets too high — it makes the stock seem cheaper. The XRP price is currently $3.36, while ETH is $3,596. However, for a bit of additional context, there are 100 billion units of XRP, while there are only 120.9 million units of ETH.

Ostrovoskis also pointed out how Ripple’s massive run-up at the end of 2024, where it surged from 50 cents to $3.30 right before Trump’s January 2025 inauguration, could still be ingrained in people’s minds. “At the end of last year, XRP had a huge move and there's a lot of recency bias behind that as well,” said Ostrovoskis. “If the market's good, again, they just go, okay, where was the most activity last year? And that was in XRP.”

One more bullish mark in XRP’s favor could be its forthcoming spot ETF, said Kavita Gupta, founder and general partner of the Delta Blockchain Fund. “That is a key factor in pushing XRP,” Gupta told Unchained. Bloomberg analysts James Seyffart and Eric Balchunas give these products a 95% likelihood of getting Securities and Exchange Commission (SEC) approval by October.

(TradingView)

What to Watch Next

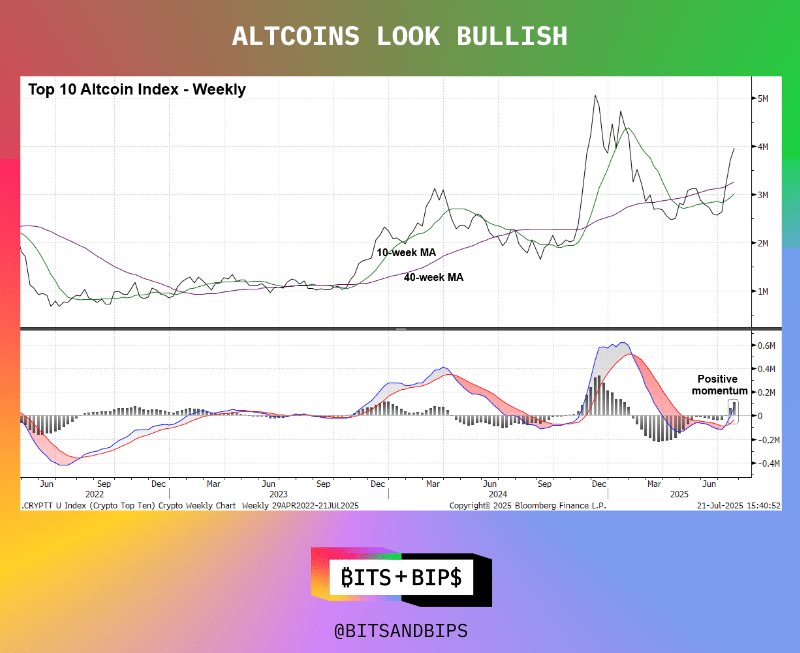

Aside from keeping tabs on a new breakout for XRP, the analysts interviewed for this story pointed to a few key assets and segments to also pay attention to as the year continues. For starters, altcoins and the broader DeFi market are expected to benefit from the fact that reserve-backed stablecoins in the U.S. will be prohibited by the GENIUS Act to pay yield to customers. This could provide stablecoins used in DeFi the opportunity to take market share.

An equal-weighted chart of the top 10 altcoins just broke through its 10- and 40-week moving averages, and its MACD also recently flipped to signal positive momentum. SOL could be one asset worth paying particular attention to, as it appears that some large traders are gearing up for big moves later in the year. “Solana obviously was really well bid after the election. It was where investors were going to put on risk and people were starting to look at stupid price targets for it into the turn of the year,” said Ostrovoskis. “But I think people were underallocated to [SOL], especially in the last three months when they decided to allocate into ETH. We are seeing that change slightly on the desk and what tends to look like is people buying quite far-out-of-the-money calls for, again, end of the year or out for three months.”

(Fairlead Strategies)

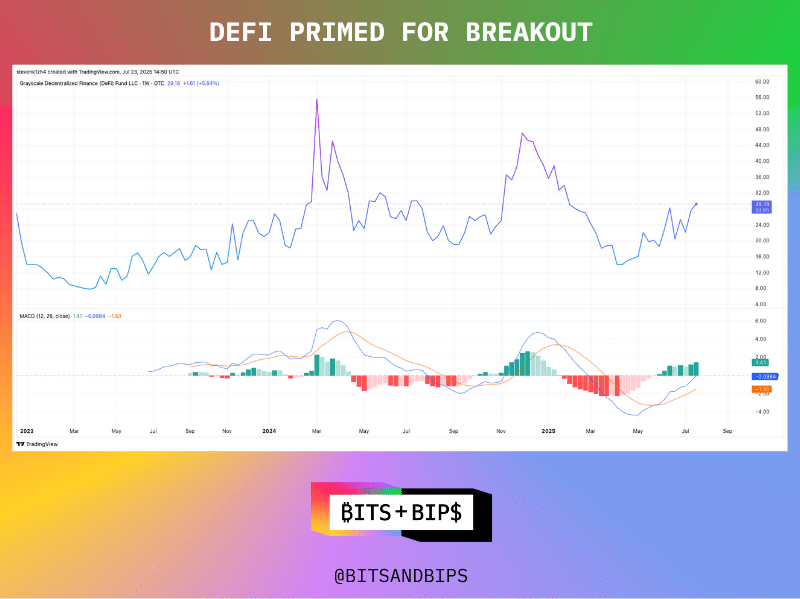

When it comes to DeFi, the analysts mentioned that many investors tend to purchase diversified exposure to the asset class, including blue-chip names like AAVE, on the spot market due to the still immature derivatives markets for these tokens. Looking at one such diversified fund, the Grayscale Decentralized Finance Fund (DEFG) shows growing momentum for this sector as well, as it could be in the early stages of its own uptrend.

(TradingView)

Related content:

Reply