- Bits + Bips

- Posts

- How Michael Saylor Will Keep Strategy From Ever Being Liquidated of Its Bitcoin

How Michael Saylor Will Keep Strategy From Ever Being Liquidated of Its Bitcoin

The company reinvented capital markets to build its stash. Now it's changing the game again.

Michael Saylor has always been a step ahead when it comes to building his cap table to accumulate bitcoin. But now he is planning to retire one of his early methods of fundraising in order to protect his pile of tokens from market downturns.

Today’s newsletter is brought to you by Mantle

Mantle is building the Blockchain for Banking — where TradFi meets Web3. Explore real-world financial tools, powered fully on-chain.

How Michael Saylor Will Keep Strategy From Ever Being Liquidated of Its Bitcoin

Since starting his accumulation strategy in 2020, Saylor has focused on keeping a clean balance sheet. Now he’s taking it to the next level.

Saylor plans to go all in on premium stock issuances (ChatGPT)

Strategy (MSTR) Chairman Michael Saylor is winning plaudits from investor circles Friday because of the company’s record performance in terms of operating income, net income, and earnings per share this past quarter (see chart below).

(Strategy)

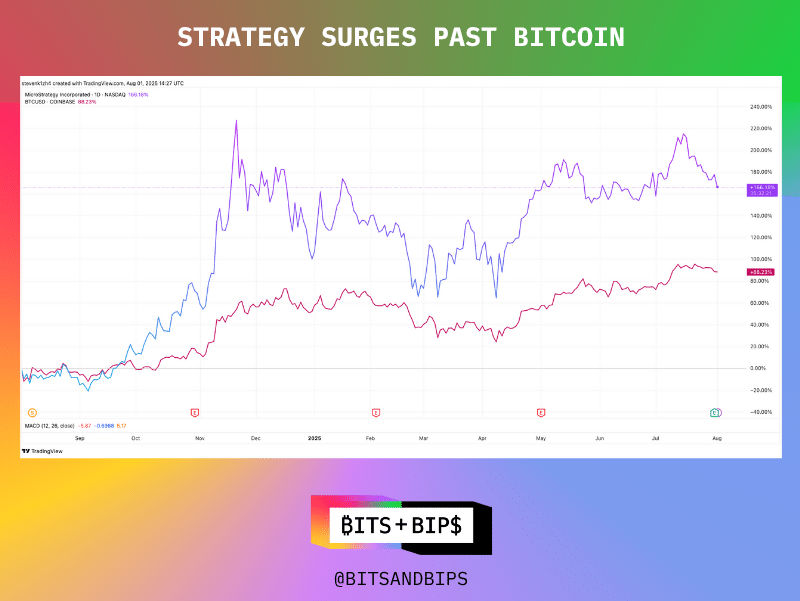

In fact, its stock is up 166% in the past year, doubling bitcoin’s (BTC) performance over that time.

(TradingView)

This is a tremendous performance according to any metric, and it is even more impressive given the cottage industry of copycats launching that could have vacuumed up investor dollars.

(The Block)

But that does not mean that Strategy does not need to evolve with the times. Its incumbent status in the crypto treasury industry comes with certain privilieges, and it appears that the company is getting ready to cash in.

Bitcoin Accumulation Keeps Growing, But Now With a Twist

As of this writing, Strategy owns 628,791 tokens worth $71.9 billion. It has built this stack by selling shares of common stock, multiple varieties of preferred forms of equity that offer either dividend payments or convertible options in the years ahead, as well as convertible debt. See the chart below for a breakdown of its various preferred offerings.

(Strategy)

But now the company wants to make an important change to how it raises funds. Specifically, it wants to get out of the debt game. Even though the firm itself maintains a fairly clean balance sheet — it only has $8.2 billion worth of debt against an enterprise value of $126 billion, according to its earnings report — it wants to bring that number to zero. In its investor call on July 31 after the earnings release, the company said that it plans to retire its outstanding convertible debt model to focus on its various tranches of preferred-stock issuance.

That means that its $6.3 billion in preferred equity offerings should get ready to soar. In fact, in its investor presentation, the company announced a plan to raise an additional $4.2 billion of its latest preferred equity offering, Stretch (STRC), which targets an effective monthly yield of 10%.

“[This decision] demonstrates the favorable evolution in [Strategy’s] ability to access the capital markets. The convertible bond market is rife with hedge funds and arbitragers who are taking long exposure on MicroStrategy by buying the convert, but then they're on a heavy delta and shorting stock to reduce their net exposure, something like 25%. So they're selling a lot of stock for every bond that they buy, and they're just a little bit long MicroStrategy,” said Lance Vitanza, managing director at TD Cowen, in an interview with Unchained (watch the full discussion on X or YouTube). “That was the best avenue for the company years ago. But as Strategy has grown, they've been able to access the preferred stock market where you just see much better terms, much better appreciation, much better torque, much better efficiency in terms of pricing.”

(Strategy)

This announcement reflects just another reason why Saylor is seen as a type of demigod in the Bitcoin community. He is hailed not just for accumulating bitcoin, but for doing it responsibly. With few exceptions, he has hardly ever leveraged his balance sheet to fundraise, primarily focusing on the equity markets instead.

And now he wants to push the envelope even further despite the fact that his clean cap table would eliminate the need for any forced liquidations absent an almost 80% bitcoin price downturn.

Not Everyone Can Follow — Yet

But — don’t expect his many followers in the bitcoin, ether (ETH), solana (SOL), binance coin (BNB), and altcoin space to follow suit. They are just starting out, and as I have demonstrated in some of my other reporting on the subject, they are competing with each other to gain scale as quickly as possible.

That means using every tool available in the capital markets toolkit, like private placements in public equities (PIPEs) and credit lines, but also including debt.

In a previous story I wrote the following: “Each [approach] comes with advantages and drawbacks. A PIPE offers an easy way to raise a lot of money in a short amount of time. This can help kickstart an accumulation strategy. But it also creates the potential for massive sell walls. Issuers could try a different method of selling stock, such as pre-registering shares with the SEC, but that can then take longer to raise the necessary funds. More companies today are taking a hybrid approach, where they might raise a third of the money via PIPEs, with the rest coming in convertible debt or credit facilities. These can delay selling pressure but also add more leverage to a balance sheet, which could be problematic if prices crash.”

What this means is that debt can come in handy when it comes to raising funds because the actual shareholder dilution may not come for several years. Plus in frothy markets like this the coupons can be next to zero. As an example, the bitcoin treasury company Twenty One sold $485 million worth of convertible debt in May to kickstart its strategy. Anthony Pompliano raised $235 million in convertible debt for his bitcoin treasury company ProCap Financial, in June.

It's essentially a way to buy now and pay later.

One of One

What this means for investors is that they must continue to remind themselves of how Strategy remains a unicorn in what is suddenly a very crowded field of crypto treasury companies. So far, it is the only such firm that has been able to tap the preferred equity markets — the first such sale only came in January. But as demonstrated earlier, much more is yet to come.

For everyone else, the ability to tap preferred markets and eliminate debt is aspirational. “It'll be common for many of these companies to begin their journeys in the convertible bond market, and hopefully some of them will grow large enough and be successful enough that they will then ultimately gain access to preferred equity markets,” said Vitanza.

Please see below for the full interview.

Related content:

Reply