- Bits + Bips

- Posts

- New Solana Treasury Company Raising $1.5 Billion to Be Led by Joe McCann

New Solana Treasury Company Raising $1.5 Billion to Be Led by Joe McCann

Joe McCann from Asymmetric has been in the news this week, but for the wrong reasons. His liquid fund was reportedly down as much as 80% this year, and he just announced that he is shutting it down. Coincidentally, he is raising as much as $1.5 billion to launch a Solana treasury company.

Today’s newsletter is brought to you by Mantle

Mantle is building the Blockchain for Banking — where TradFi meets Web3. Explore real-world financial tools, powered fully on-chain.

New Solana Treasury Company Raising $1.5 Billion to Be Led by Joe McCann

McCann has been in the news this week because of reported poor investor returns at his firm Asymmetric. But according to a pitch deck seen by Unchained, he might be moving on to a new position.

Accelerate is looking to raise $1.5 billion (ChatGPT)

Joe McCann, the founder and CEO of crypto hedge fund Asymmetric Financial, is set to become the CEO of a new Solana (SOL) crypto treasury company called Accelerate according to pitch documents seen by Unchained.

The firm intends to go public via a SPAC with the blank check vehicle Gores X Holding.

For McCann, news of this new venture comes at an awkward time, as he has been the talk of the crypto industry over the last day because of reports that Asymmetric’s liquid fund is down 80% so far this year. The broader crypto market is up by almost $600 billion year to date and bitcoin itself set an all-time high above $123,000 last week.

However, one investor in the deal, who requested anonymity, pushed back on a narrative on X that McCann could be looking at Accelerate as a type of escape hatch for his flailing fund. “My instinct is that all of this stuff has been in the works for quite some time. While it might seem coincidental, this fundraising has been happening for months behind the scenes,” the investor told Unchained.

Aiming for the Top

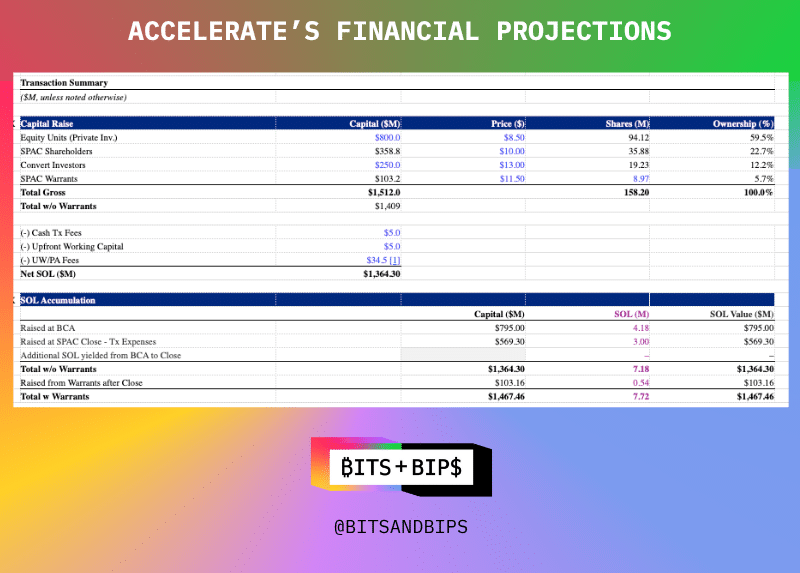

The company plans to raise as much as $1.51 billion, according to an investor presentation and financial model obtained by Unchained. The model indicates $800 million will be raised via a private investment in a public enterprise (PIPE), the SPAC will provide $358.8 million, $250 million will be raised through convertible debt, and $103.2 million will be sold in SPAC warrants.

(Screenshot by Unchained)

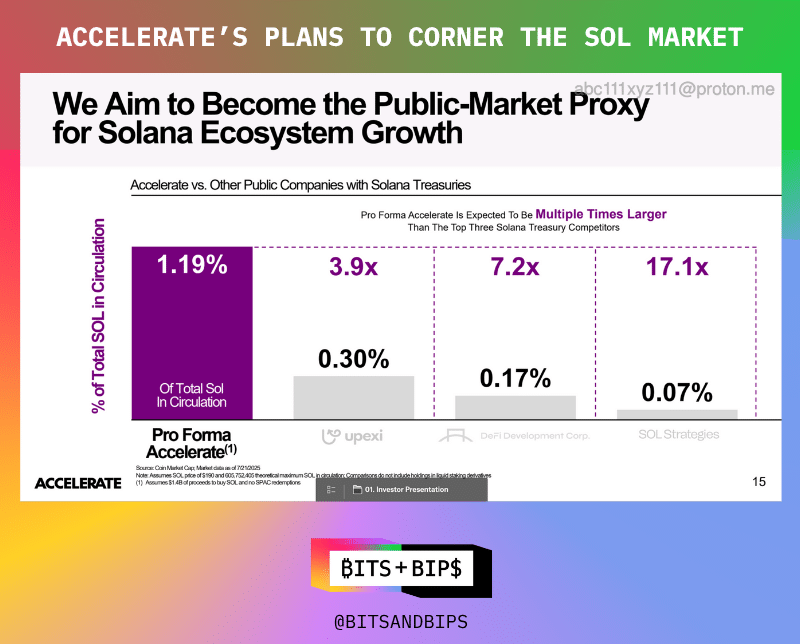

If the fundraise is successful, it would instantly make Accelerate the largest SOL treasury company in the market. That title is currently held by Upexi (UPXI), which holds 1.9 million SOL ($381 million). After fees and other operating expenses, the company plans to have $1.36 billion to buy SOL, which would translate into 7.32 million tokens at today’s price of $186.31.

However, these numbers are subject to change as other major Solana treasury companies like DeFi Development Corporation (DFDV) and Sol Strategies (HODL) all have plans to raise additional capital to gradually increase their token holdings.

(Screenshot by Unchained)

The Upside — and the Downside

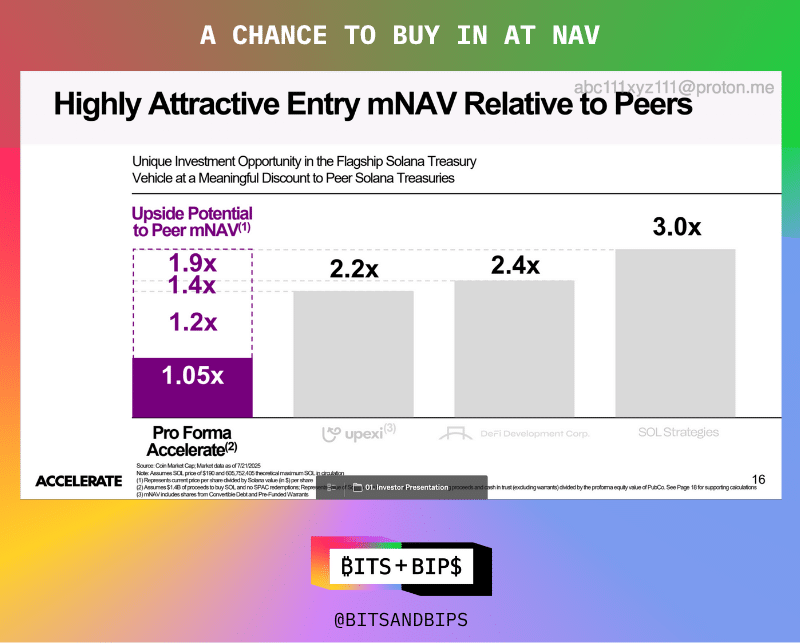

A key selling point referenced in the investor presentation is the ability for participants to invest in the company close to a net asset value of 1, meaning that they would be in a position to reap substantial gains if the stock price sees similar increases to those that have occurred with other crypto treasury companies.

(Screenshot by Unchained)

However, the risk here — especially for retail investors who could be caught buying at a local top — is a rapid price reversal once shares sold via PIPEs in these companies become liquid. This was a phenomenon detailed in a previous Unchained investigation after two PIPE companies, including Upexi, saw significant price drops after shares sold to private investors became liquid.

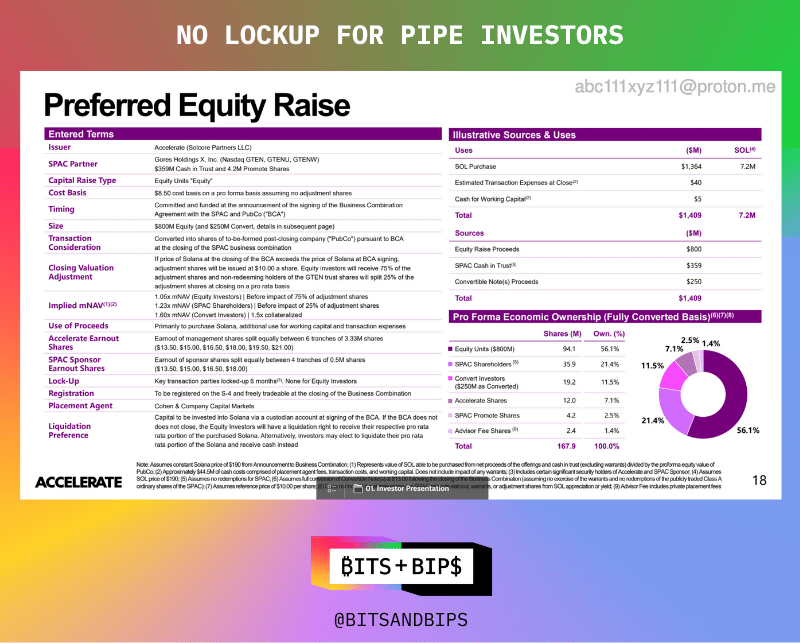

According to the presentation viewed by Unchained, key personnel’s shares will be locked up for six months, but PIPE investors will have immediate liquidity once the shares become registered with the Securities and Exchange Commission (SEC).

(Screenshot by Unchained)

Potential Impact of the Liquid Fund News

For the aforementioned investor, a big selling point was Accelerate’s deep bench beyond McCann. “[Chief Strategy Officer] Komal Sethi has been in tech for a long time and he's also really smart about legal and financial dealings. And that's the kind of brain that you need, because a lot of this is actually financial engineering in the public markets,” said the investor.

Still, questions remain about McCann’s future, and while the investor had no immediate thoughts on whether this could impact McCann’s role as CEO, he said that given the important role that investor confidence plays in fundraising it could be something worth discussing amongst the Accelerate team.

Wednesday afternoon McCann published a long post on X announcing the retirement of Asymmetric’s liquid fund and offering to return funds to investors. “I’ve notified our LPs that we are shifting away from liquid trading strategies,” wrote McCann. “Investors in our liquid funds have been given the choice to exit (irrespective of any customary lock-up periods) or to roll over available capital into a specific illiquid investment.”

A representative for McCann, who is one of the cohosts on Unchained’s podcast Bits + Bips, said he was unavailable to answer questions.

It remains unclear how much of the $1.5 billion has been raised, but the investor said that a “substantial amount” has been brought in. Also unknown is the precise closing of the deal, but Unchained was told that a reasonable time estimate would be the end of 2025.

Related content:

Reply