- Bits + Bips

- Posts

- Solana DATs Keep Delaying Private Investors' Ability to Sell Their Shares

Solana DATs Keep Delaying Private Investors' Ability to Sell Their Shares

Investors want to be able to cash out. But it’s not up to them.

DAT stocks have a history of performing poorly after public investment in private equity (PIPE) shares get unlocked, which allows early investors to cash out on their holdings. This was even true during bullish periods of the year.

But now, companies are starting to delay the registration process for these shares, likely due to fear of massive selling into a bearish climate. At least one company is also trying to use other tricks and methods to limit selling pressure when shares do become registered, and investors are often left with little recourse.

Now some readers will feel little sympathy for institutional investors who have a reputation for dumping on retail. Those feelings can certainly be valid, but these delays will have practical implications for individual investors as well.

And with the Securities and Exchange Commission (SEC) still closed amid what is soon to become the longest government shutdown of all time, things may not change anytime soon.

Before we go on, I’d love to hear from you.

This short survey will help us craft stories that truly resonate with you.

Today’s newsletter is brought to you by Mantle

Mantle is building the Blockchain for Banking — where TradFi meets Web3. Explore real-world financial tools, powered fully on-chain.

Solana DATs Keep Delaying Private Investors' Ability to Sell Their Shares

Amid sinking prices and a history of poorly performing unlocks, some companies are hesitant to register PIPE shares. Investors are left with little recourse.

PIPE shares are being kept under lock and key (ChatGPT)

On Oct. 20, the Solana Digital Asset Treasury (DAT) firm Solana Company (HSDT) moved forward with an expected unlock of private investment in public enterprise (PIPE) shares from its $500+ million fundraise to provide early investors with liquidity. Like other stocks that underwent similar unlocks, HSDT immediately plunged over 40%, and it is yet to recover these losses.

(TradingView)

Perhaps for this reason two prominent competitors in the Solana space decided to delay the registration process for their own PIPEs.

One firm, Forward Technologies (FORD), which raised $1.65 billion in its PIPE deal, which closed on Sept. 11, and is led and backed by prominent firms such as Multicoin Capital, Jump Trading, and Galaxy, delayed its registration process on Oct. 10 for an additional 30 days, pushing the timeline into November. It was fortuitous timing, as Oct. 10 is known as Black Friday in the crypto world, when $19 billion of collateral was liquidated, the worst such event in industry history. Another, Solmate Infrastructure (SLMT), issued a similar delay on Oct. 22, pushing out its registration filing deadline to Nov. 22 for its $300 million PIPE.

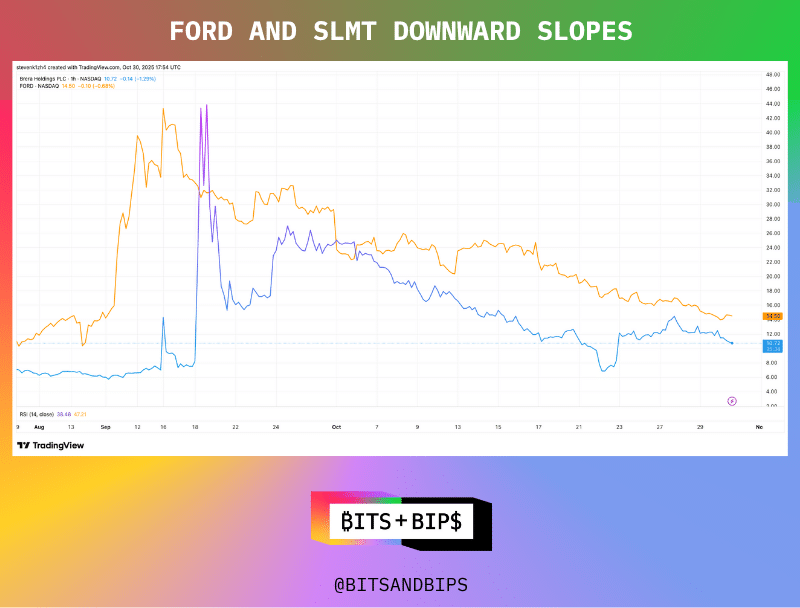

Both stocks are substantially down from recent highs as the price of solana languished. FORD is down 66.8% and SLMT has dropped 75.56%.

(TradingView)

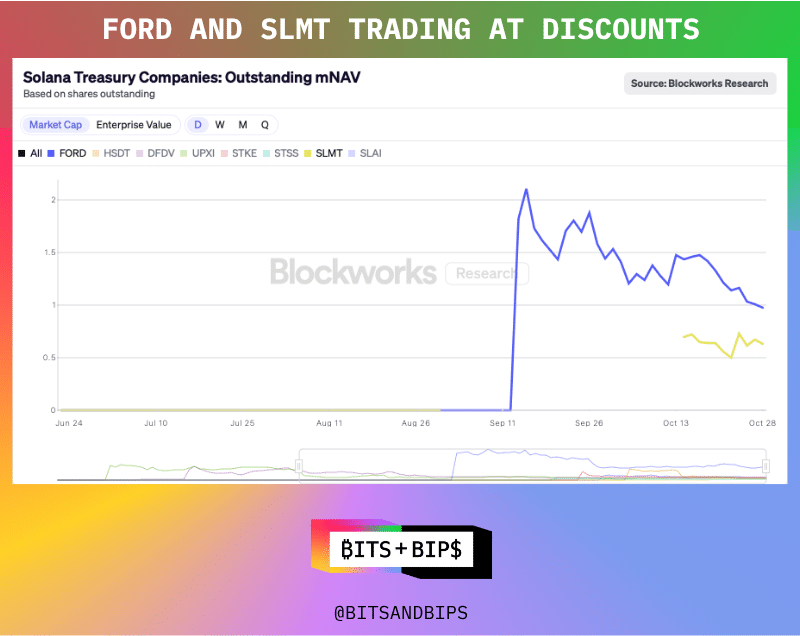

Additionally, both companies are trading at a discount to the value of their crypto holdings.

(Blockworks)

These actions are leading to a range of reactions from investors. Some claim that their shares are essentially being held hostage and have received little communication from the teams. “We were told that we would get all the stocks in our hand in a normal filing after 30 to 45 days and everything will be unrestricted,” an investor in FORD, who requested anonymity, told Unchained in an interview. “Nothing else was shared with us, but it has been a very painful experience.”

Others are more sanguine about the process. Another prominent investor who has incurred multiple registration delays said, “I don't think we're for or against the delays. It all depends on the company. And so in certain instances, in order to be successful here, you want to wait for catalysts that allow you to generate volumes.”

A representative for FORD declined to comment to Unchained on the delays.

Unchained received the following statement from a Solmate Infrastructure spokesperson in response to a similar inquiry: “The company's investors were overwhelmingly supportive of the extension with well over the required 50.1%. Investors voted to extend the time to register shares to allow for the company to prepare, articulate and execute on its new infrastructure initiatives and acquisition strategy. The company has also released a strategic business and operational update which articulates our commitment to these shareholder-accretive priorities.”

One thing that is clear is that the tension between investors and DAT management teams is going to grow, particularly in a climate where crypto continues to languish, companies trade at discounts to book values and their primary regulator, the SEC, remains closed amidst an extended government lockdown, which could offer firms a handy excuse to delay filings.

FORD’s Liquidity Offramps

Navigating a PIPE unlock is already tricky business because DATs are usually formed by a management team taking over a penny stock and then dramatically inflating the circulating supply by 1,000x+%. This math means that it only takes a small percentage of PIPE shares entering the market to create a price crash. These companies can be a ticking time bomb.

It is for this reason that some companies try to get creative in managing the scale of this sell pressure. Unchained received copies of two communications from FORD in which the firm took unorthodox steps to circumvent the unlocking of PIPE shares.

The first was a resale prospectus of the management team that would allow 50% of PIPE shares to be unlocked on Oct. 14, with the rest being released 30 days later.

“All – please find attached a draft of the Resale Prospectus Supplement for your review. We will assume sign-off on the information contained in your corresponding footnote if no comments are received by 2:00 p.m. New York time on Friday, October 10.

The resale prospectus supplement will become effective on Tuesday, October 14 pre-market. At that point, 50% of the shares will be released from the lock-up, with the remaining 50% released 30 days later.”

A second effort sent in October sought to achieve far longer lockups for shares by tokenizing them on Solana and using them as collateral in the decentralized finance (DeFi) ecosystem to generate yields.

“As the most Solana-aligned publicly traded company, we’re excited to invite you to hold your shares on-chain on Solana mainnet via our Digital Transfer Agent Superstate. Solana is home to the most vibrant blockchain-based capital markets, allowing you to use your FORD shares as collateral and to trade 24/7 via various DeFi platforms that are integrating with Superstate in the coming weeks. Some of the initial examples include: Drift (where you can use your FORD shares as collateral to trade perpetual futures), Kamino (where you can use your FORD shares as collateral to borrow stablecoins and other assets), Jupiter (where you can trade FORD shares 24/7).”

The FORD investor said that part of this offering included agreeing to lockups starting with six months. FORD representatives also declined to comment about these offers and communications.

Brewing Tension Amidst a Closed D.C.

To be fair, PIPE management teams in other industries are also wary of these giant walls of sell pressure. “This is unrelated to the DAT phenomenon, but people are paying more attention to trying to manage having the lockups expire, having maybe three or four expiration dates that are spaced out by maybe a month or two months between them,” said one attorney who has worked on multiple DAT deals. “So you don't just have this doomsday day six months after closing or one year after closing, where this huge overhang of stock just crushes the price.”

But this inevitably creates tension between management and investors. The attorney noted that he’s come across numerous instances, even outside of crypto, where management tries to negotiate with investors for additional lockups or restrictions, but they are met with resistance. “They'll obviously try to get the PIPE investors to agree to lockups, but they usually won't do it,” he said. “The PIPE investors are just like, ‘No, my lockup is the fact that I have unregistered shares and you need to fix that as fast as possible.’”

As the crypto market continues to languish, DAT companies continue to trade at discounts, and the federal government remains closed, this tension is likely to only increase.

But management teams have at least not publicly tried one excuse that may not fly — blaming further delays on the SEC being unavailable to review registration forms.

Investors’ Recourse: The Rubberstamp Tactic?

Typically when any issuer files a registration statement, be it a new ETF, company going public, shelf offering, or PIPE issuance, they include a delaying amendment. This clause essentially requires that even if a waiting period for an issuance to become effective lapses, the shares cannot become tradeable until the issuer receives a formal response from the SEC. But this is a best practice, not a requirement.

Investors in crypto DATs are now asking management teams to consider waiving such clauses from registration forms. “What investors are pushing for is for issuers to consider that they would circumvent that normal process by just filing a registration statement that contains no delaying amendment, so it'll just become effective after 20 days,” said the attorney. “This dynamic is related to everyone that's trying to do a PIPE at this point.”

But it is a risky strategy, as the SEC is not completely absent behind the wheel. The regulator still maintains essential personnel that could halt trading for a certain stock or product if necessary. “My own reaction is I doubt anyone would do that,” said the lawyer. “I certainly wouldn't.”

And, importantly, investors cannot force the hands of management. The decision to forgo a delaying amendment is entirely at the discretion of the company.

Worth Ripping the Band-Aid Off?

Ultimately though, the bigger discussion point is whether it is better for a DAT to simply register the PIPE shares and deal with the fallout right away or play the negotiating game with investors. HSDT’s stock and mNAV (which also trades at a significant discount) have not yet recovered, but at least the company is likely through the worst of the pain and it can move forward. It can also credibly tell its next set of investors, which could include more traditional financial firms rather than the usual coterie of crypto hedge funds, that it will comply with its obligations.

(Blockworks)

It will be virtually impossible for any DAT to raise funds while it trades at a discount to its treasury, but firms who delay registrations with no end in sight will have additional questions to answer.

Said one investor, “HSDT decided to move forward. So now maybe that's an advantage for [the company] as well, because a lot of institutional investors, the big money, they're waiting for that unlock to see how the PIPE performs [how the stock reacts to the unlock]. As the market conditions come together, is that an advantage for HSDT? Do I deploy there or into some of these [DATs] who have not unlocked because I'm concerned that the unlocks are going to cause a hiccup in the price as people take profits before it stabilizes?”

Chart of the Week — USDe Loses $5 Billion in Market Cap

(Ethena)

Ethena’s USDe has dropped from 14.7B on Oct. 10 (crypto’s latest Black Friday) to 9.5B today: a $5B shrink in just 20 days. That’s a big move for what had been the fastest-growing stablecoin in the market.

What’s driving the unwind?

Yields have cooled. The 30D avg APY on sUSDe sits at just 4.37%, down from much higher levels when funding spreads were wide and the basis trade was crowded.

Perception risk. On Oct. 10, USDe briefly traded as low as $0.65 on Binance. This wasn’t a global depeg, since the peg held firm on Curve and other venues, but Binance’s thin liquidity and flawed oracle setup caused localized chaos.

Even though redemptions worked and the system stayed overcollateralized, it may have spooked users. For most stablecoin holders, optics matter more than mechanisms.

For context, USDT supply grew from 177B to 183B over the same period, a 6B gain.

Not all of that came from USDe, but the divergence shows where market trust still flows when things get shaky.

— Juan Aranovich, managing editor of Unchained

Related content:

Reply