- Bits + Bips

- Posts

- The Onchain5 Part 2: Robinhood and Stripe Upgrade Finance's Back End

The Onchain5 Part 2: Robinhood and Stripe Upgrade Finance's Back End

Fintech powerhouses disrupt themselves with crypto.

Coinbase was an example of a company expanding its crypto trading operation into a full-stack ecosystem of blockchain-based businesses. The next two are scrappy startups that disrupted the big boys of finance. Now, their broad customer bases make them leaders in the horse race to bring the masses onchain. Which of the different paths will help them come on top?

Today’s newsletter is brought to you by Mantle

Mantle is building the Blockchain for Banking — where TradFi meets Web3. Explore real-world financial tools, powered fully on-chain.

The Onchain5 Part 2: Robinhood and Stripe Upgrade Finance's Back End

Both companies became billion-dollar businesses by disrupting slow and expensive incumbents. Now they are going onchain to flip the script again.

Stripe and Robinhood are disrupting themselves with blockchain technology (ChatGPT)

Robinhood: Putting Tokenized Assets in Its Quiver

TLDR: Going onchain lets Robinhood extend its core edge — retail UX and order flow — into a broader, global, and programmable model. Tokenization makes assets more usable in real time, Robinhood Chain expands and monetizes flows in new ways, Bitstamp provides an international foothold, and programmable assets open the door to new financial products inside Robinhood’s UX.

Robinhood’s (HOOD) business has always been built on flows — creating the best retail trading experience in order to capture order flow and monetize it through payment-for-order-flow. In Q2 2025, the company processed $517 billion in equities trading volume (plus another $28 billion in crypto) for its 26.5 million customers. When it comes to crypto, the firm now offers everything from its own wallet to staking services and selling perpetual futures.

Investors have noticed, as its stock is up 408.9% in the past year.

(TradingView)

But the company is not resting on its laurels. In fact, it is using its growing crypto trading business as a launchpad to reimagine every facet of its operations.

First, moving trading onchain geographically broadens its addressable market and facilitates trading 24/7/365. Instead of being limited to U.S. equities during market hours, Robinhood can adopt crypto’s “always open” nature by tokenizing new asset types — stocks, ETFs, even synthetic derivatives. Its 2024 acquisition of Bitstamp also strengthens this push, giving Robinhood licensed EU rails under MiCA and a compliant venue to route tokenized assets globally — a shortcut to international scale without building broker-dealer infrastructure in every market.

The prize could be huge. According to a June 2024 report from McKinsey, the “total tokenized market capitalization could reach around $2~4 trillion by 2030 (excluding stablecoins), driven by adoption in mutual funds, bonds and exchange-traded notes (ETN), loans and securitization, and alternative funds.” And that is still just scratching the surface of global capital markets, which reached $115 trillion in 2024, according to a report from the Securities Industry and Financial Markets Association (SIFMA).

Second, moving onchain makes trades directly monetizable for the company. The firm’s “payment for flow” (PFOF) practice means routing trades to external market makers like Susquehanna or Citadel. Onchain rails allow Robinhood to experiment with new ways to capture value: spreads on tokenized assets, protocol or liquidity fees, even sequencer revenue if its new blockchain (Robinhood Chain) evolves.

Robinhood Chain could even reframe PFOF itself. Instead of selling order flow off-chain to external market makers, Robinhood could make access to retail flows native to its chain. Partners — brokers, liquidity providers, or market makers — would compete to service that flow, while Robinhood monetizes access at the protocol layer. In effect, PFOF becomes embedded in the rails.

(Ryan Yi)

The Real Benefit of Tokenization for Customers

For users, the key value proposition of tokenized equities isn’t just shaving down settlement — it’s also about being able to take more actions with their assets immediately. On Robinhood today, stocks are bought, cleared, then held — at which point a user can take additional actions. For example, margin borrowing requires account-level collateral, and often a 1-2 day delay before new deposits or stock purchases count toward margin. With tokenized assets, that friction disappears — a tokenized Apple share could be posted as collateral and borrowed against in real time, with proceeds available instantly across apps.

Plus, Robinhood won’t need to build every market itself — it can plug into liquidity that forms natively onchain through existing DeFi protocols. Users get access to a wider menu of products, while Robinhood becomes both a gateway for tokenized flows and the venue where that liquidity concentrates, capturing engagement as it moves through its platform. The result is higher user counts, more flows, and deeper engagement, and Robinhood absorbs the infrastructure lift of offering those products directly.

Here are the different types of tokenized products that could become popular on Robinhood Chain:

Stablecoin yield: Robinhood Wallet can integrate stablecoins directly, offering savings-like products tied to onchain yields. Robinhood already offers programs that have up to 4% APY for cash balances that are not invested. Programs like this could grow in particular because putting these funds onchain can generate yields anywhere between 4.84~5.04% (based on current DeFi lending market rates).

Yield-bearing products: Tokenized stocks can be lent out via DeFi platforms, creating passive income streams. At this point in time, this market is being led by private credit funds, which comprise $16.7 billion of the $29.2 billion industry, according to data from RWA.xyz. The next biggest category is tokenized treasuries at $7.4 billion (see chart below).

New product formats: Robinhood could distribute pre-IPO shares or other synthetic wrappers as liquid, tradable instruments. The company already piloted some examples of this category, offering tokenized derivatives tracking the price of shares in OpenAI and SpaceX.

(RWA.xyz)

Changing Stripes: A Leap From Analog to Onchain

Stripe already powers millions of merchants with three pillars: wide merchant distribution, a global payments network, and best-in-class developer experience. It processed over $1.4 trillion in total payment volume in 2024, up nearly 40% year over year and equating to a little over 1% of global GDP.

But that scale cannot completely eliminate certain limits: margins are thin on processing, cross-border corridors are expensive or inaccessible, and merchants still stitch together banks and tools to service their lifecycle operations.

In fact, beneath the clean UI/UX offered by Stripe lie clunky and inefficient layers of banks, card networks, and various payment rails. Each of them takes a cut from transactions powered by Stripe. Stripe is certainly more than putting a shiny new coat of paint on an aging vehicle, but right now its service is not the equivalent of changing out the engine.

But that is about to change, as Stripe has embarked on a plan to replace these inefficient legacy rails with clean and instant blockchain-based fast lanes. What’s more, it is building an onchain vertical tech stack that will power every facet of these transactions, leading to more cost savings for customers and new sources of revenue for the company.

There are four key building blocks to this strategy.

Bridge: Stripe acquired Bridge as its stablecoin orchestration layer. It manages issuance and redemption, handles onchain FX between currencies, and enables programmable treasury flows like automated payouts or cross-border settlements. In practice, it replaces card networks and correspondent banks with stablecoin rails that Stripe controls.

Privy: Stripe also acquired Privy, a wallet infrastructure provider already powering 75M+ accounts. Privy is being embedded into Stripe’s APIs so that any merchant can provision wallets for customers or contractors by default. This keeps refunds, rewards, and payouts inside Stripe’s network rather than flowing out to banks.

Stablecoins: Stripe today supports USDC, USDG, and USDP. Over time, Bridge is designed to make Stripe's network stablecoin-agnostic, mediating flows across multiple issuers. Stripe may also issue its own stablecoin to capture float yield, while enabling merchants to issue branded stablecoins that plug directly into Stripe’s rails. The focus isn’t on defining stablecoins, but on using them for settlement, payouts, rewards, and treasury management at merchant scale.

Tempo (Stripe Chain): Stripe and Paradigm are incubating Tempo, a payments-first blockchain. It offers predictable low fees, sub-second finality, opt-in privacy, and EVM compatibility, with gas and settlement in any stablecoin. Tempo will support use cases such as stablecoin payouts, remittances, and microtransactions, and will decentralize over time.

The driving principle behind this shift is to incorporate as much of the payment process, and the economic benefits, into Stripe’s own network. If the plan is successful, customer balances will stay in Stripe-owned accounts, and revenue will accrue from payment processing fees, FX transactions, and yield strategies.

See the chart below for a comparison between Stripe’s legacy system and its “onchain” future.

(Ryan Yi)

Here are a couple of tables showing how adopting tokenization and blockchain technology will change the way that Stripe does business.

Onchain lets Stripe offer a superior product offering and business outcome.

Before | Settlement takes several days; FX is costly; refunds and rewards are siloed as gift cards or store credits; merchant balances idle in banks, managed across fragmented tools. |

After | Sales settle instantly into Stripe wallets at near-spot FX. Balances are yield-bearing, with treasury flows (payouts, FX, financing, reporting) unified in the Stripe dashboard. Refunds and rewards become stablecoin credits spendable across Stripe merchants. Payouts to suppliers or contractors can move 24/7. |

Stripe Benefit | More balances stay in-network, Stripe captures yield, FX spread, mint/redeem fees, and programmable treasury revenues. Revenue rises without fee hikes, and merchants see Stripe as their treasury backend, not just a checkout provider. |

Onchain lets Stripe expand globally with less friction.

Before | The majority of Stripe’s flows come from U.S.-based companies. Expanding to geographies like LatAm and Asia can be opaque, slow, and fee-heavy. Cross-border flows run through card networks and correspondent banks and many long-tail markets are uneconomic, and merchants face capital drag from settlement delays that may span 7~14 days. |

After | Stablecoin rails and onchain FX settle in seconds, are transparent end to end, and operate 24/7/365. Contractors and suppliers can be paid directly to wallets instead of waiting on wires. Small businesses can participate in cross-border trade without the drag of legacy banking. |

Stripe Benefit | Stripe can enter or scale markets where card rails are too costly or absent. By bypassing Visa/Mastercard tolls and correspondent banking, it captures FX economics directly while offering merchants cheaper, faster settlement. Its distribution becomes truly global, on rails it controls. |

Onchain broadens Stripe’s product surface while preserving developer simplicity.

Before | Merchants patch together multiple vendors — banks, wallets, FX providers, payout platforms — while Stripe remains just the processor. Compliance and licensing remain on the merchant. |

After | One Stripe API now exposes wallets, stablecoin issuance/treasury, and a settlement layer aligned to merchant SLAs. Refunds, rewards, payouts, and treasury functions all run inside Stripe. Developers enable onchain features by adding parameters, not vendors, while compliance and licensing are abstracted. |

Stripe Benefit | Stripe delivers more “jobs to be done” inside its stack, from payments to treasury. Developers stay loyal, merchants deepen their reliance, and Stripe captures the economics of the entire money lifecycle. |

Takeaway: Onchain lets Stripe graduate from a processor on top of card networks into a programmable network for businesses. Clients get instant settlement, cheaper cross-border, and integrated treasury services. Stripe gets higher revenues, global reach, and a deeper developer moat.

Risk: Execution and integration. Bridge (orchestration), Privy (wallets), and Tempo (settlement) are shipping as discrete products. If they remain siloed, Stripe gains but the “win” condition is a unified platform experience where onchain is simply “more Stripe,” not more complexity.

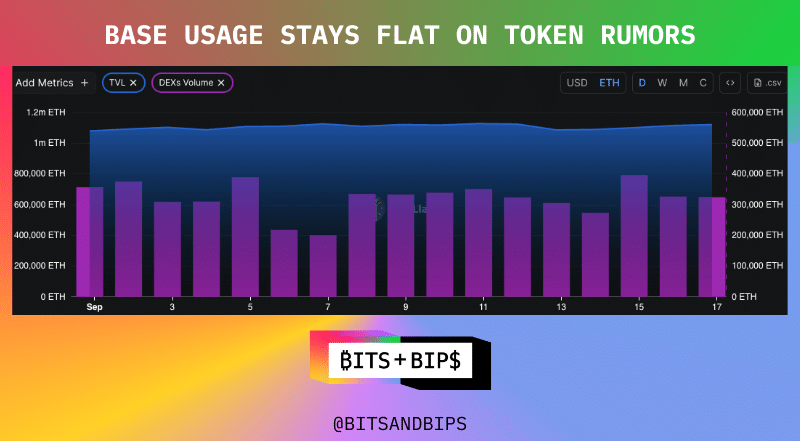

CHART OF THE WEEK: Base’s TVL & Activity

— Juan Aranovich

When Base said it was “exploring” a token on Monday, I expected a wave of airdrop farming.

But… nothing.

TVL, activity, DEX volume — basically flat over the past 48 hours.

Here’s the chart, measured in ETH, so that we can account for price fluctuations.

(DeFiLlama)

Why? We can’t be certain, but here are a few guesses:

Airdrop fatigue. Recently, the LINEA airdrop disappointed not only in terms of price action but also in terms of the allocation users received

Base is already huge, so new deposits barely move the needle

People may think the snapshot already happened, so why even bother?

If Ryan Yi’s estimates on Unchained are close, the token could be worth $50B.

Even a 20% community allocation = $10B airdrop.

Feels like something’s off here.

Related content:

Reply