- Bits + Bips

- Posts

- Why Gold Rose and Bitcoin Tumbled on Japan Bond Turmoil

Why Gold Rose and Bitcoin Tumbled on Japan Bond Turmoil

Equities, bonds, and crypto fell together while gold hit new highs. Japan’s bond market explains why and what it means for portfolios.

Markets tanked this week.

US stocks fell hard. Global equities followed. Long-dated bonds sold off. Bitcoin dropped below $90,000, ETH and SOL were down double digits on the week, and close to $900M in crypto leverage was wiped out in the past 24 hours.

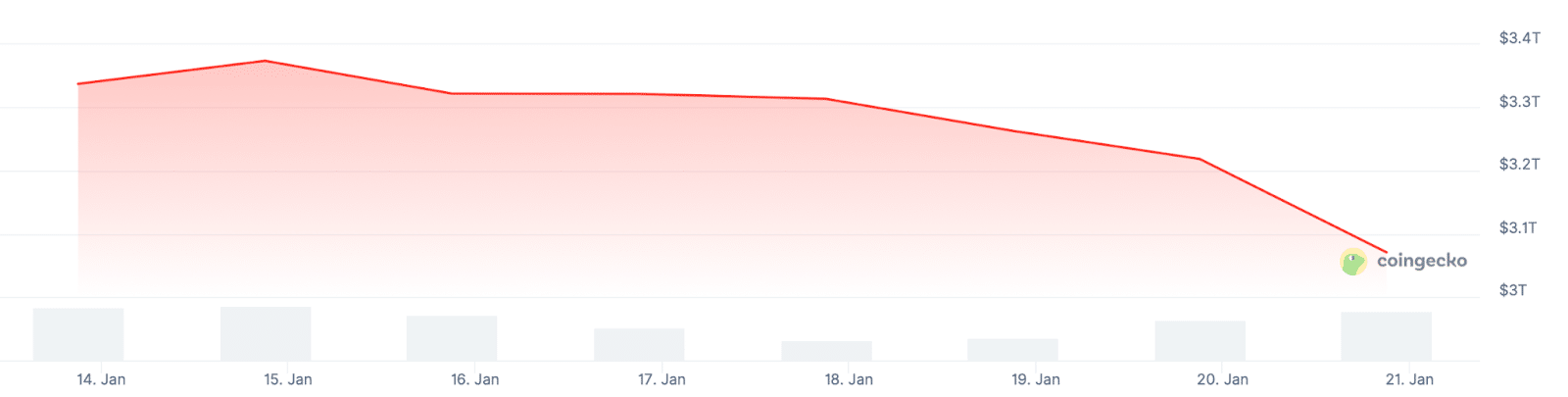

Crypto’s total market capitalization has lost $300 billion since Jan. 14.

Source: Coingecko

Gold went the other direction and hit new all-time highs.

That combination is the story. When stocks, bonds, and crypto are all under pressure at the same time, while gold quietly rallies, it usually means the problem isn’t a single asset. It’s the system around them.

The spark this time came from Japan.

In the rest of this article, we’ll go over:

Why Japan triggered this selloff

Why gold acted like a hedge and bitcoin didn’t

The startling historical gold-vs-stock pattern that may be repeating

How to rethink portfolios when correlations rise

Reply